Key takeaways

- Startup sourcing enables corporates to access innovation, scale faster, and stay competitive in rapidly evolving markets.

- Companies like Microsoft, Mastercard, Spotify, Walmart, and Uber have successfully partnered with startups to enhance their offerings and enter new markets.

- Common goals include testing new business models, adopting emerging technologies, expanding customer bases, and increasing revenue streams.

- These partnerships combine the agility of startups with the resources and reach of large enterprises, creating high-impact results.

- Effective startup sourcing involves clear strategic alignment, cultural fit, and a structured engagement process.

Cutting-edge startups are transforming entire industries, leveraging new technologies, ideas and business models to gain market share. It’s an environment where being the first to seize new growth opportunities can make or break a business putting large (and traditionally slow-moving) corporations at a disadvantage.

In response, companies all over the world are partnering with external startups as a way to tap into their agility, creativity and disruptive ideas to:

- Test new business models

- Access and experiment with cutting-edge technologies

- Launch new products and services

- Generate new revenue streams

Startup sourcing is a critical component in the process, enabling companies like Microsoft, Mastercard, Spotify, Walmart, and more to spot, attract and engage with startups that align with their organisation's long-term growth goals and vision.

To give you a better idea of how startup sourcing can help boost your corporate innovation strategy, we’ve listed five inspiring real-world examples below.

But first, let's kick things off with some context.

What Is Corporate Startup Sourcing?

Corporate startup sourcing is the process by which established companies identify, evaluate, and engage with startups to gain access to innovation, talent, and disruptive technology.

Key benefits include:

- Faster product development

- Access to new markets or user segments

- Lower innovation risk

- Improved adaptability to change

According to a study by BCG, 65% of corporations have engaged with startups in the past three years as part of their innovation strategies.

Why are top corporates partnering with startups?

Large corporations often struggle with slow internal innovation processes. Partnering with startups allows them to:

- Test cutting-edge business models

- Leverage emerging tech like AI and IoT

- Launch new services faster

- Respond more quickly to market shifts

These partnerships are a strategic way to reduce time-to-market and mitigate the risks of falling behind.

1. How Microsoft expanded its developer ecosystem with GitHub

Acquisition: $7.5B acquisition of GitHub in 2018

Why it worked: GitHub had a massive global user base (85+ million developers)

Results: Increased reach for Microsoft developer tools and access to new talent

Developers are the lifeblood of the software industry, and open-source communities can be a veritable treasure trove of innovation and collaboration. So it's not surprising that a company like Microsoft would want to tap into that ecosystem. Their sourcing efforts led to the acquisition of GitHub in 2018 for $7.5 B.

The deal, which was initially aimed at enhancing Microsoft’s open-source presence, bringing its tools and services to new audiences and boosting GitHub’s use among enterprises, ended up bringing in valuable new talent as well.

2. How Mastercard used RiskRecon to boost cybersecurity

Acquisition year: 2019

Startup solution: Automated risk assessments of third-party vendors

Outcome: Enhanced Mastercard’s ability to protect digital assets

In today’s digital landscape, data breaches and cyber-attacks are a big threat, putting billions of dollars and customer trust at risk. It was this threat that led Mastercard to scout and acquire RiskRecon back in 2019, a provider of AI and data analytics solutions designed to help businesses protect their digital infrastructure.

The acquisition significantly benefited RiskRecon by providing them access to Mastercard's global reach and resources, enabling them to scale their solutions to a much wider customer base. For Mastercard, the benefits include more secure transactions and stronger customer trust, reinforcing the company's position as a leader in secure digital payments.

3. How Spotify used Anchor to expand into podcasting

Acquisition year: 2019

Impact: Anchor-powered podcasts made up 80% of Spotify’s new shows in 2020

Benefits: Increased engagement, expanded ad inventory, and diversified content

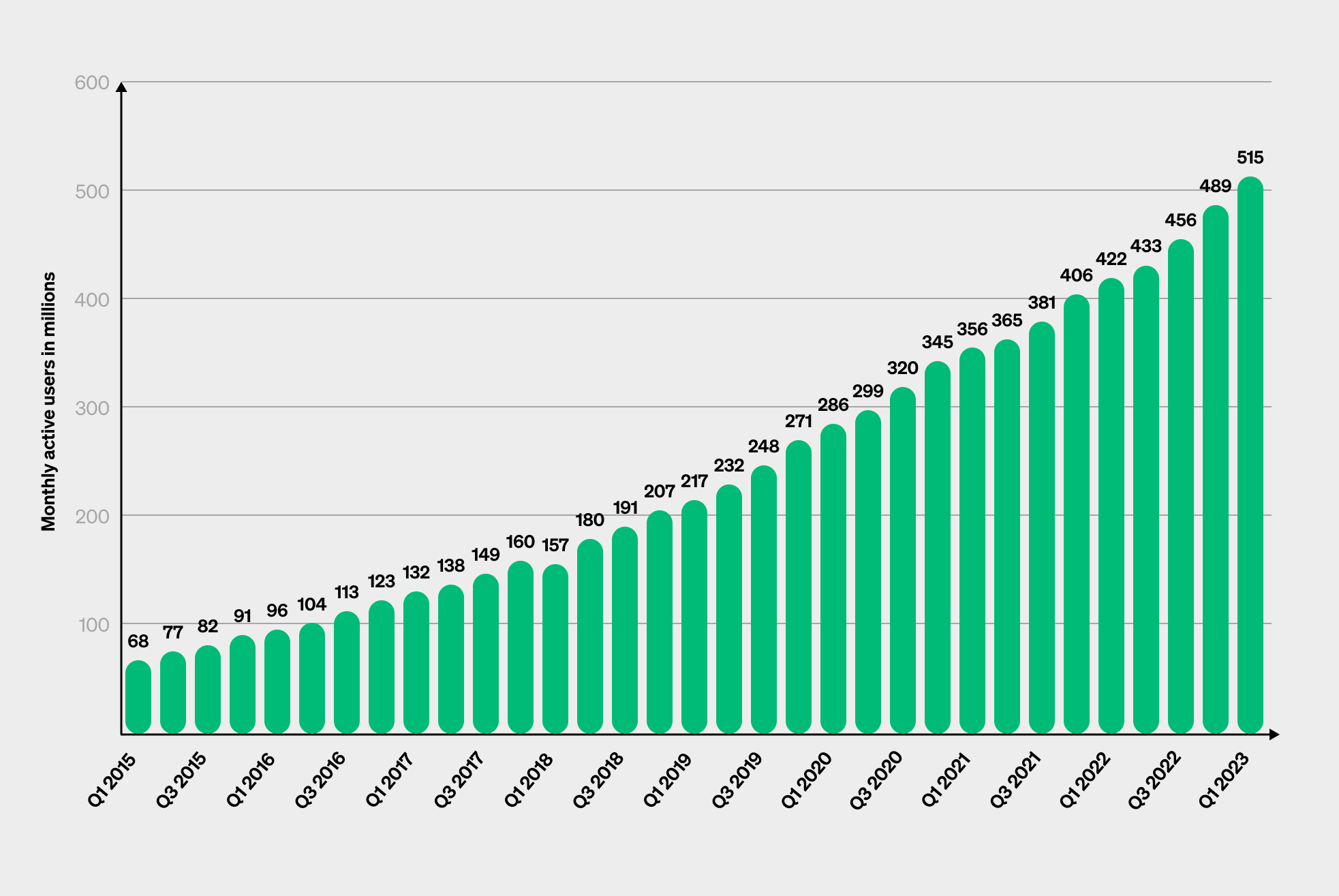

Spotify has over 515 million active users around the globe. That’s even more impressive when you factor in that they came from 68 million in 2015. So how do they keep their users growing and engaged? Short answer: They launch new offerings.

In 2019, Spotify successfully sourced and acquired Anchor (now known as Spotify for Podcasters), a startup that enables users to create, publish and monetise podcasts. As explained by Daniel Ek, founder and chief executive of Spotify:

“We believe it is a safe assumption that, over time, more than 20% of all Spotify listening will be non-music content. This means the potential to grow much faster with more original programming. Our core business is performing very well. But as we expand deeper into audio, especially with original content, we will scale our entire business.”

Here are just a few of the benefits:

- Higher user engagement: The ability for users to create their own podcasts via Anchor led to increased engagement on Spotify's platform. Higher engagement levels often translate into improved user retention and longer listening times, both critical metrics for any streaming service.

- Advertising opportunities: With more podcast content, Spotify was able to open up more advertising slots. This expanded its advertising potential and created a new avenue for revenue, helping to balance the significant costs associated with music licensing.

- User base expansion: Anchor was a popular platform among podcast creators, and its integration attracted these creators and their fans to the service, expanding Spotify's overall user base.

The move is paying off, with Anchor powering 80% of new podcasts on Spotify in 2020 alone. Anchor podcasts also had the highest “time spent listening” than any other third-party podcast hosting or distribution provider (e.g. NPR, Wondery, etc.) on the platform that year.

4. How Walmart used Flipkart to enter the Indian market

Investment year: 2018

Impact: Enabled Walmart to enter India’s rapidly growing $200B market

Benefits: Access to digital payments (PhonePe), and expanded its tech capabilities

In the retail industry, new markets are essential, and a good way to gain access fast is by sourcing the right partners. Case in point, Walmart’s $16 B investment in Flipkart, India's biggest online retailer, back in 2018. The allure? The Indian e-commerce market (worth $38 B in 2017) is expected to reach $200 B by 2027. The deal also enabled Walmart to better compete against Amazon (who also made a bid) in the new market. For more details on the deal, check out this video.

Here are just a few factors that made the sourcing of Flipkart a success:

- Brand Image: Walmart, lacking a strong brand image in India, gained recognition through its acquisition of the highly popular Flipkart.

- PhonePe: Walmart can use PhonePe, Flipkart's subsidiary, and an Indian government-verified Unified Payments Interface (UPI), to grow its online business.

- Access to Talent: The acquisition provided Walmart access to Flipkart's large talent pool, including Indian IT professionals renowned for their skills and ingenuity.

- Addressing Flipkart's Struggles: Flipkart, struggling to generate profits against Amazon's aggressive discounting strategy in India, found a robust partner in Walmart.

5. How Uber used Postmates to diversify and scale

Acquisition year: 2020

Impact: Diversified revenue during pandemic-driven ride-hailing declines

Benefits: Expanded services, improved market share, greater operational efficiency

During the pandemic, Uber recognised the need to diversify its offerings and reinforce its food delivery arm, Uber Eats. They looked to the startup ecosystem for a solution, setting their sights on Postmates - a food delivery service known for its expansive network and robust partnerships with businesses large and small. The $2.65 B acquisition enabled Uber to expand its array of restaurants and offer the delivery of a wider variety of goods. This diversification was crucial in cushioning Uber against the slowdown in demand for ride-hailing during the pandemic.

The move brought a wide array of benefits for Uber, including:

- Income diversification: The addition of Postmates’ delivery-as-a-service model opened up new sources of revenue, providing a much-needed financial cushion.

- Expanded delivery services: With Postmates under its wing, Uber Eats was able to facilitate the delivery of a variety of goods from local businesses, effectively expanding its market reach.

- Increased market share: Acquiring Postmates allowed Uber Eats to strengthen its position in key areas (e.g. LA and the American Southwest) and gain a larger share.

- Access to established partnerships: Postmates had already built strong relationships with numerous eateries and other businesses. This network was a valuable asset for Uber.

- Greater operational efficiency: With both Uber Eats and Postmates operating under the same umbrella, there were opportunities for operational efficiencies and cost-saving measures (e.g. consolidating delivery routes, sharing technical infrastructure, etc.).

The move highlights the importance of startup sourcing in driving corporate success and navigating market uncertainties.

Frequently Asked Questions (FAQ) about corporate startup sourcing

Q. How can startup sourcing support your long-term innovation strategy?

Startup sourcing gives corporations faster access to emerging technologies, talent, and business models—without the time and cost of building internally. It supports long-term innovation by continuously feeding the pipeline with fresh, market-tested ideas.

Q. What’s the best way to align startup partnerships with corporate goals?

Start by clearly defining your strategic objectives (e.g., entering new markets, enhancing product offerings, or digitising operations). Then, scout startups that not only meet technological needs but also align with your company’s mission, values, and risk tolerance.

Q. How do you ensure successful integration after acquiring or partnering with a startup?

Success hinges on cultural alignment, leadership buy-in, and a clear integration roadmap. Establish joint KPIs, maintain open communication channels, and allocate dedicated internal resources to manage the partnership post-deal.

Q. What risks should executive leadership consider in startup sourcing?

Key risks include:

• Misalignment on vision or pace

• IP or compliance issues

• Poor integration planning

• Overvaluation or hype cycles

Mitigate these by involving legal, tech, and business units early in the sourcing process and conducting rigorous due diligence.

Q. How do leading companies structure their startup scouting efforts?

Successful companies often set up dedicated innovation teams, corporate accelerators, or venture client units. Others outsource scouting to firms specialising in startup ecosystems, using platforms, databases, and innovation networks for deal flow.

Q. Is startup sourcing relevant for companies outside of tech-heavy industries?

Absolutely. From retail and healthcare to logistics and finance, every industry faces disruption. Startup sourcing helps future-proof operations, tap into new business models, and stay ahead of shifting customer expectations.

Final thoughts

These examples highlight the importance of forging the right partnerships, and it all starts with startup sourcing. When implemented the right way, startup sourcing can lead to partnerships that unlock unprecedented growth quickly and with a reduced level of risk.

They can be a game-changer for companies navigating today’s uncertain landscape or having trouble competing due to rapidly changing technologies, outdated business models or the arrival of new players in the market.

—

Looking to attract and engage with cutting-edge startups that align with your organisation's long-term growth goals and vision? We can help you tap into the external startup ecosystem, build strategic partnerships, and unlock new opportunities for growth through collaboration.

.svg)