Key takeaways

Fintech solutions have radically disrupted traditional banking practices, giving way to a new era of more convenient, efficient and, in many cases, instant options to manage our finances. Case in point, a corporate startup by Goldman Sachs: Marcus.

Online banks seem to be popping up everywhere, with fewer restrictions, more convenience and an ever-increasing number of patrons (e.g. Wise, N26, Chime, Revolut, etc.). Traditional consumer banks are doing their part to keep up, launching their own fintech ventures with some pretty stellar results (e.g. SurePay, Vipps).

But what happens when a 150-year-old B2B investments bank decides to throw its hat into the digital consumer banking arena?

This is our Corporate Startup of the week:

In this article, we’ll be taking a closer look at Marcus (named after Marcus Goldman, one of the bank’s original founders) and how it enabled Goldman Sachs to leverage its brand, balance sheet, and risk-management DNA to bring in an extra $1,2 B in revenue for 2020.

About Goldman Sachs

Headquartered in New York and founded in 1869, Goldman Sachs is one of the world’s largest and most prestigious investment banking enterprises. It has over 40,5 thousand employees, a presence in over 60 cities and a recorded revenue of $44,56 billion for 2020.

Goldman Sachs offers its customers a variety of banking and financial services, including:

- Investment banking

- Consumer wealth management

- Asset management

In 2016, the bank made a strategic decision to increase its revenues by expanding into the consumer banking market with a digital-only offering. As described in a Harvard Business Review case study:

“The move marked a dramatic cultural as well as product shift: the 150-year-old institution historically served only businesses and the wealthiest of individuals.”

One of the authors of that same case study, Rory McDonald, described what he considers to be the reasons behind the shift during a podcast interview:

- The pursuit of growth through innovation.

- To leverage a bank holding company licence acquired during the 2008 financial crisis.

- To compete with emerging fintech and other non-banking lenders in the market.

The result was a venture known today as: Marcus by Goldman Sachs.

Meet Corporate Startup, Marcus

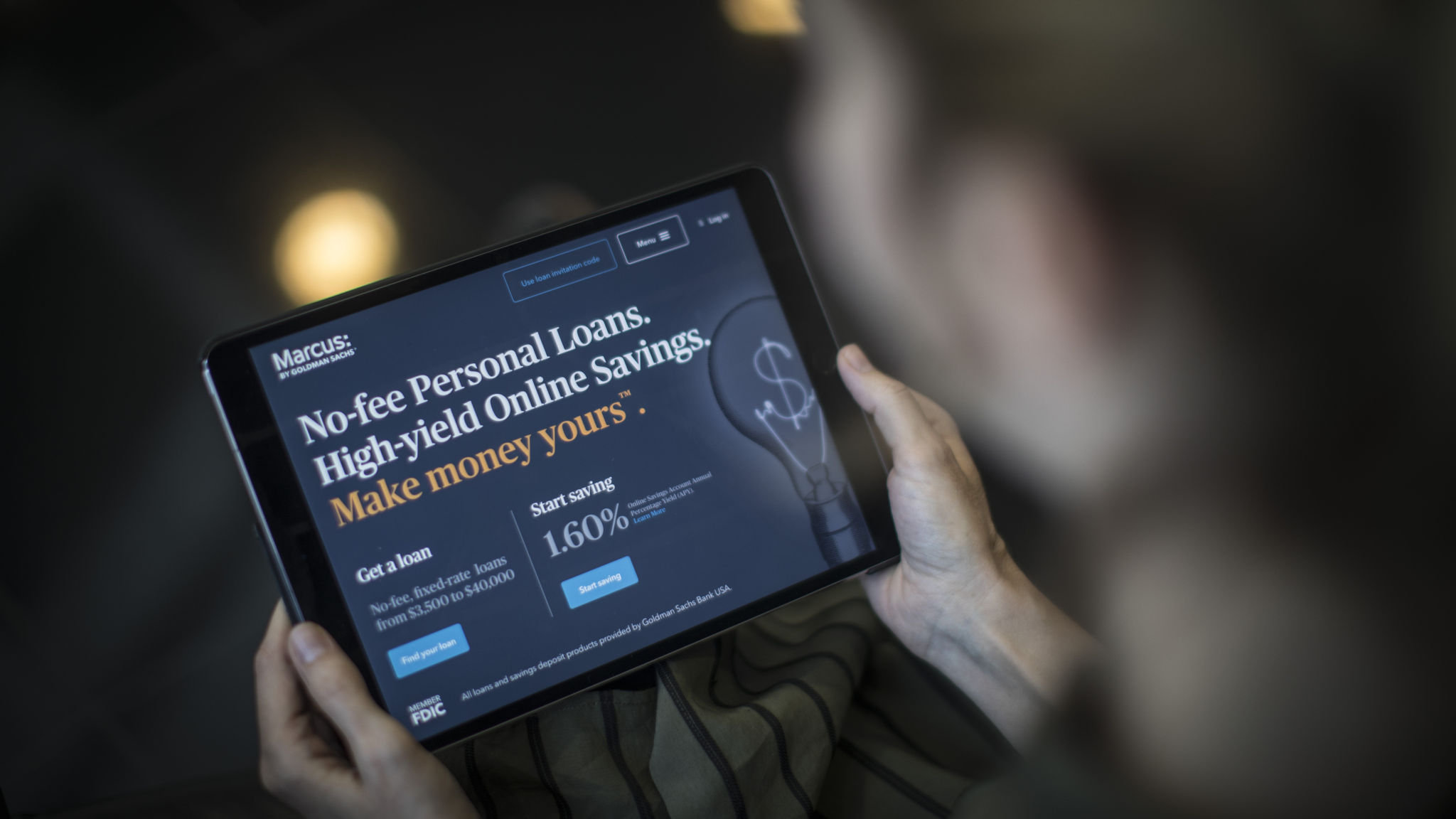

Marcus made its debut into the world of consumer banking, offering unsecured personal loans for the mass market. Under the simple slogan, “you can money”, it continued to grow at a rapid pace, rolling out its high-yield deposit service the very next year.

From the beginning, Marcus was developed as a startup within Goldman Sachs, as opposed to residing in a separate location. This was meant to support the new venture’s assimilation into the greater organisation.

By 2018, the service expanded to include customers in the UK, and by 2019, they had a credit card partnership with Apple. By the end of 2020, Marcus had reached $1,2 B in annual revenue, $100 B in deposits and $8 B in consumer loan balances.

The road to success wasn’t smooth at all, and there was a lot of scepticism around the concept, both within the bank and externally. In 2019, the Wall Street Journal published a critical article describing some of the hurdles experienced by the new venture, including:

- Cultural differences between the new team and internal stakeholders

- The journey to finding the right name, brand and identity for Marcus

- Initial losses due to the lack of a collections team for delinquent borrowers

- The challenge of establishing the right partnerships

Finding the right core team for the job was also a challenging endeavour because it involved finding leaders with the right experience and the ability to navigate the established culture within the bank. As described by McDonald:

“...just because you have a really smart, capable person, who’s climbed the ranks at Goldman, it doesn’t mean they’re going to be great at running a consumer startup within Goldman. Meanwhile, if you have the best entrepreneur in the world, it doesn’t mean they’re going to be great at running a venture that has to interface with the culture and the processes and priorities of this larger organisation.”

Despite some of the initial bottlenecks, Marcus managed to thrive, consistently getting positive reviews from organisations like Forbes, Investopedia and Bankrate. Their success is not to be taken lightly, with plenty of predecessors that have tried and failed with similar ventures:

How Marcus works

Marcus offers its customers four main types of services:

High-yield savings accounts and certificates of deposit (CDs)

The services in this category revolve around helping clients find the right option to “make the most of their money”. Savings options include:

- Online savings accounts with 0,50% annual percentage yield

- Seven-month, no penalty CDs with 0,45% annual percentage yield

- Twelve-month, high-yield CDs with 0,55% annual percentage yield

Savings accounts with Marcus charge no opening, maintenance or transaction fees. They also have no minimum deposit or balance requirements.

Automated investing

Marcus Invest enables users to:

- Have a portfolio based on their desired risk level and timeline

- Safely invest in pre-vetted exchange-traded funds (ETFs) and managed portfolios

- Open an investment or retirement account starting at $1000

Personal loans

The Marcus personal loan service offers users:

- Loans from $3.500 - $40.000 with no fees

- Fixed rates ranging from 6,99% to 19,99% APR

- The option to skip a month after twelve consecutive, on-time payments

Smart tools

Marcus Insights offers users various free tools and trackers that deliver personalised insights to make more informed financial decisions. These tools are accessible through the Marcus app or Marcus.com, even for non-customers.

The benefits for Goldman Sachs

Launching a startup like Marcus was a huge gamble not only because it required a substantial investment but also because its failure could have hurt the Goldman Sachs brand and reputation. But the gamble is surpassing all expectations.

Through the new venture, Goldman Sachs has been able to:

- Create an important new revenue stream for the future

- Tap into a whole new market

- Effectively expand beyond investment banking into online consumer banking

- Gain invaluable insights about the new customer base

- Form valuable partnerships with companies like Apple

In addition, Marcus enabled its parent company to effectively leverage existing corporate assets to create new revenue. Some of the assets leveraged include:

- Reputation - The Goldman Sachs name fosters trust among both clients and partners, making it easier to attract both.

- Bank holding company licence - This licence was purchased years earlier and remained unused until the Marcus venture.

- Industry expertise - Marcus was able to thrive with over 150 years of banking and finance experience to back it.

- Partnerships - Established industry networks, acquisitions and partnerships helped make this venture a reality.

- Infrastructure - Marcus got its start inside Goldman Sachs with existing equipment, support and housing.

What’s next?

Earlier this year, Goldman Sachs announced its plans to launch an automated investment app for Marcus customers in the UK. The launch is scheduled for the first quarter of 2022. As explained by Des McDaid, the Head of Marcus in the UK:

"We have been delighted with how fast and how quickly we have grown. The challenge now is how do we repeat the formula we used for savings to offer our customers an accessible platform for investing products."

Marcus is also going through a change in management following the departure of Omer Ismail, former Head of Consumer Business (who left to work on a new Fintech startup by Walmart). New appointments include:

- Chantal Garcia as Chief Operating Officer (COO)

- Liz Ewing as Chief Financial Officer (CFO)

- Scott Young as Chief Comercial Officer (CCO)

- Abhinav Anand as Managing Director

The chief executive role previously occupied by Omar Ismail will be filled by former Uber VP of Technology, Peeyush Nahar. The infusion of new talent is sure to take Marcus to new heights in its development, and we can’t wait to see what the next steps will be.

__

Would you like to explore new growth markets or take your existing venturing strategy to the next level? We can help you build a tailored strategy that that leverages your unique corporate assets and meets your growth goals for the future.

50 Corporate Venture Examples

Find out how top companies build ventures from scratch to unlock markets, fuel growth, and generate new revenue.