Key takeaways

Technological advances like cloud computing and AI have drastically changed the way we do business, making it harder for traditional corporations to compete in today’s market.

Just look at some of the most recent stats:

- 50% of today’s S&P 500 are forecasted to be replaced in the next ten years.

- 80% of executives feel their company’s business model runs the risk of being disrupted in the near future.

- Over 40% of today’s corporations will be dead in 10 years.

But it’s not all bad news! Corporations everywhere are beating the odds by embracing innovation and coming up with their own industry-disrupting technologies.

Case in point, John Hancock: The 156-year-old finance firm behind Twine, a savings and investment app built to help couples allocate funds, invest in customized portfolios and reach their financial goals.

Proof that even the most traditional firms can effectively compete in today’s fast-moving, technology-driven markets.

John Hancock, embracing innovation

Owned by the Canadian-based firm Manulife, John Hancock offers investment, insurance, and retirement services to a wide array of clients.

Like most of today’s senior corporations (e.g. Cigna, JP Morgan Chase, GE, etc.), they’ve placed innovation at the forefront of their business strategy, with the goal of embracing the latest technological trends and avoiding disruption by smaller, more agile startups.

Their efforts include:

- Building an in-house innovation team

- Engaging in growth hackathons

- Partnering with promising startups

- Launching Manulife’s Lab of Forward Thinking (LOFT)

Through these efforts, both John Hancock and Manulife have managed to foster an environment in which ideas can be prototyped and launched without the typical bureaucratic barriers that exist within most corporations.

Additionally, John Hancock has made it a priority to encourage innovative ideas and free-thinking among its employees by providing the tools, resources, and programs they need to execute their disruptive ideas.

LOFT, in particular, has been charged with the task of pursuing promising concepts on a test and iterate basis and promoting the ones with the highest potential. In essence, their goal is to explore new ways of blending traditional products and services with new technologies and making them more attractive to younger clients.

A corporate startup is born

In 2015, John Hancock purchased Twine, a financial services AI startup, as part of their ongoing efforts to embrace new and innovative technologies.

From the beginning, Twine began its journey as an autonomous organizational unit based in San Francisco, but with close ties to its Boston-based parent company. Despite being located in different cities, the relationship between the two companies is quite similar to that of any corporate startup. In this case:

- The parent company offers financial support and corporate resources like legal, marketing and commercial expertise

- The startup serves as a source for out-of-the-box thinking and new technologies

Today, the Twine team is made up of about 25 employees including engineers, product managers, user experience designers, and marketing staff.

Competing in a saturated market

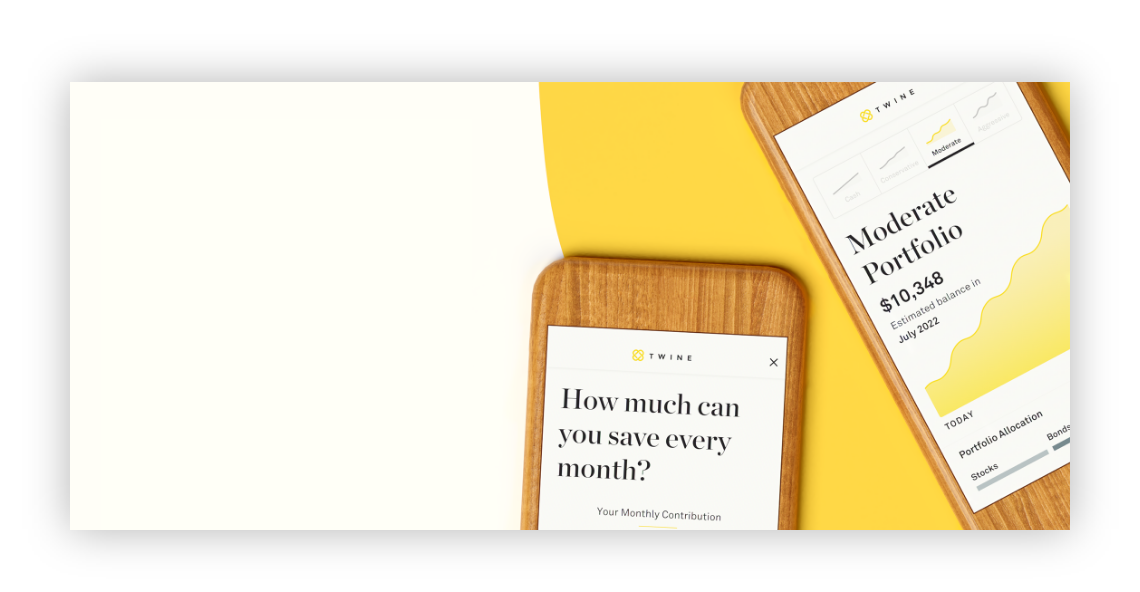

There are quite a few savings and investment apps currently in the market, with most finance firms offering their own variations. These are just a few of the most popular ones:

With so many similar apps on the market, what makes Twine unique?

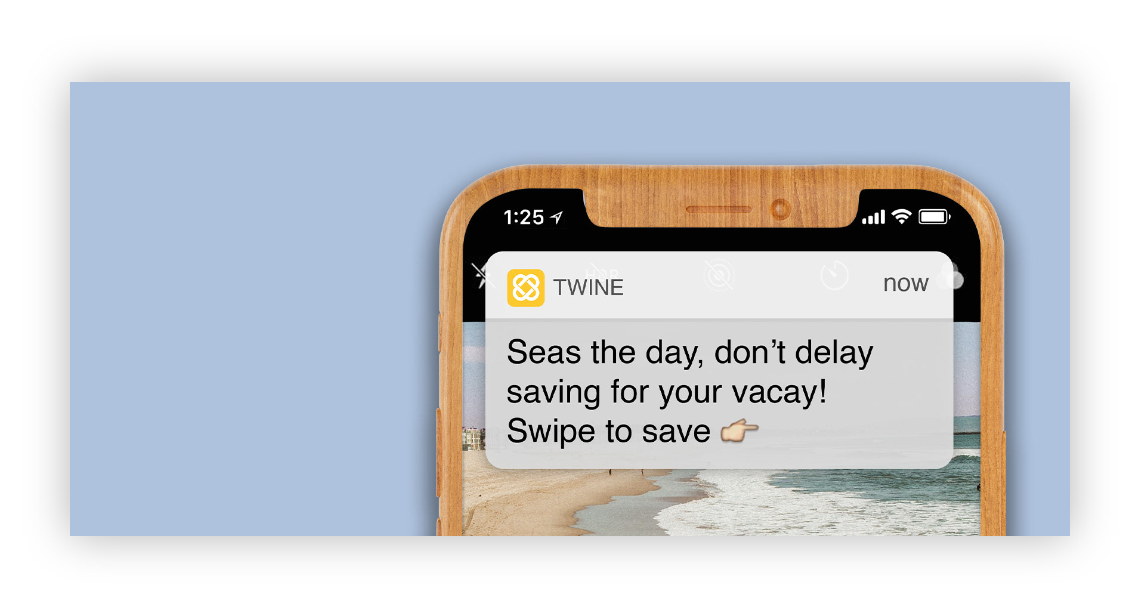

Like many of the apps mentioned above, Twine was designed to help its users save and invest, with one added benefit: It was specifically designed for couples, particularly those with separate bank accounts.

Financial independence is a growing trend among Millennial and Gen Z couples, but what happens when they want to start saving for a mutual goal?

That’s where Twine comes in.

The app makes it easy for users to keep independent accounts, and still team up with a spouse or partner to save for mutual goals (e.g. vacations, weddings, retirement, etc.). This is a unique feature in the savings app landscape because most only support a single user.

Additional benefits include the fact that Twine offers fairly competitive interest rates on savings and that their portfolios are backed by their reputable parent company, known for its investment services. Best of all, you can start a savings account for free.

A corporate startup success story

The story of John Hancock and Twine is just another example that illustrates how mutually beneficial a corporate startup partnership can be, helping corporations drive innovation and helping startups gain the resources they need to execute their projects successfully.

Today, Twine is still going strong, with rave reviews from clients both married and single and an award for Best Overall Fintech App from FinTech Breakthrough in 2019. As described by James Johnson, Managing Director at FinTech Breakthrough:

“Twine is a standout Fintech innovator for this year’s program, bringing the sharing economy to the Fintech sector and helping individuals collaborate to reach their financial goals”

As for John Hancock, their innovative spirit and many efforts have paid off in spades, and the success of Twine is only the beginning. Most recently, LOFT hosted its annual Hackathon meant for employees across all disciplines to bring forth their most creative and innovative ideas.

The result was COIN, a conscious investing platform that empowers individuals to build personalized portfolios around the social causes that are most important to them.

We can’t wait to see what they’ll come up with next!

Do you want to share your corporate startup story with the community, or do you have a question about intrapreneurship? Let’s talk!

50 Corporate Venture Examples

Find out how top companies build ventures from scratch to unlock markets, fuel growth, and generate new revenue.