Key takeaways

Around the world, there are two conversation topics the people in most cultures will do their best to avoid: money and death.

Besides old-fashioned, this tabu can be incredibly damaging for the people who go through their whole life avoiding the subject. Most importantly, it denies them the chance to be educated about protecting themselves and their families against the uncertainties of life.

With over 167 years of experience, Massachusetts Mutual Life Insurance Company knows a thing or two about this. The company realized that millennials—the young adults who are now turning thirty and are beginning to start a family—are less likely to get life insurance, compared to the previous generation. This generation is used to spending 5 minutes online buying pretty much anything, so when it comes to picking and applying for life insurance—a process that might take weeks or even months—it comes as no surprise that they feel discouraged.

“The relationship that most people have with their life insurance company is a monthly bill. They have coverage in place, make their premium payments, and hope their loved ones will never have to use it,”

– Yaron Ben-Zvi, CEO and Co-founder of Haven Life

The life insurance industry has remained unchanged for decades and is still living in a paper-centric world, trapped in bureaucracy loopholes and agents’ commission deals. No strangers to corporate venturing, MassMutual knew they could do something about this. Their previous initiatives, Society of Grownups and ValoraLife, were essential learning experiences to come up with the startup that would bring the field miles ahead of the competition.

Haven Life was born in 2015, a completely digital insurance company. Haven aims to have customers focus on the personal milestones that lead them to need life insurance, instead of the scary events and consequences, which are traditionally associated with the process.

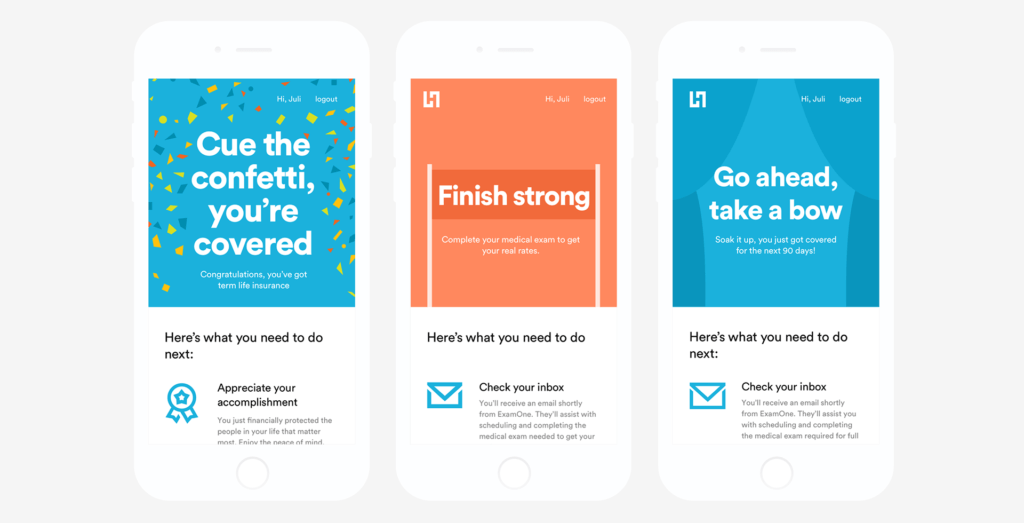

“We’re taking an approach where it’s a celebratory experience; buying life insurance is associated with the best moments in people’s lives,”

– Adam Weinberg, Content Director at Haven Life

This mindset switch is sustained by an open-minded approach to the insurance process: the online calculator will even tell you when you actually don’t need insurance at the moment. After calculating your policy and guiding you through the sign-up process, the algorithm takes an average of 48 seconds to decide whether your application is approved or not. If it is, your coverage starts immediately; otherwise, it takes Haven’s team up to six days to manually analyze your case and provide you with an update (which is still a pretty good record.) The New York-based startup can even evaluate medical results in real time, with no human interaction.

Most impressively, Haven Life delivers an incredibly user-friendly, approachable and warm experience, as if you were actually talking to another human through the entire process. Their copy is casual and lightly humorous, giving users the impression they’re talking to an old friend. Their blog articles range from insurance advice to life lacks, reinforcing the feeling they don’t just want to sell insurances, but also educate young adults on how to get a grip over their finances. Branding and Social Media are used brilliantly to gather attention from potential clients, convince them to sign up, and collect feedback.

“It’s an example of us as a brand inserting some humor and levity to life insurance, an experience that most people don’t expect to have,”

– Brittney Burgett, Marketing and Communications Director at Haven Life

Haven Life is fully owned by MassMutual, but it has been set up as a separate entity. Unlike most corporate ventures we’ve covered until now, the startup actually emphasizes this relationship as a way to create a sense of security and confidence. The banking and insurance worlds are particularly difficult fields for starting a new company in since customers want to be reassured that their money is in safe hands. However, Haven Life has been acting 100% independently from the start—with its own team, office, and CEO,— to grow and adapt quickly, and avoid being biased by the mother-brand.

“We chose to keep Haven Life distinctly separate from MassMutual to provide it with the autonomy it needs to foster creativity and an entrepreneurial spirit,”

– Gareth Ross, Chief Digital and Customer Experience Officer at MassMutual

Do you want to share your corporate startup story with the community, or do you have a question about intrapreneurship? Let’s talk!

50 Corporate Venture Examples

Find out how top companies build ventures from scratch to unlock markets, fuel growth, and generate new revenue.

.svg)