Key takeaways

- Corporate spin-offs create strategic focus for both parent and new entity by allowing each to concentrate on its core competencies.

- Spin-offs unlock hidden value in underperforming units by giving them autonomy to attract new investors and resources.

- The financial benefits flow both ways, with parent companies generating returns through sales or IPOs while spin-offs implement tailored strategies that boost value.

- Risk mitigation becomes more manageable when companies isolate the financial and operational risks of exploring new markets or technologies.

- Innovation speed increases dramatically as independent entities gain the agility to respond quickly to market changes free of corporate constraints.

In today’s fast-moving landscape, corporate spin-offs can help companies reduce risk, streamline their focus, and boost stakeholder returns.

It’s a strategic process in which a parent company separates a venture to create a new, independent entity. This can happen in several ways, including:

- Distribution of shares to existing shareholders

- Direct sale of shares to new investors

- A combination of both methods

But how do corporate spin-offs actually create value for the parent company?

To answer this question, we’ve outlined five ways spin-offs can benefit both the parent and the newly formed entity, each backed by a real-world example.

But before we get into that part, let’s kick things off with some context.

What is a Corporate Spin-off?

A corporate spin-off is created when a parent company separates a venture to create a new, independent entity. The newly formed company operates autonomously, with its own management team, resources, and strategic objectives. These corporate spin-offs often retain strong ties to the parent company through shared investments, strategic partnerships, or equity stakes.

Companies choose to spin-off ventures for a variety of reasons, including:

- Boosting innovation: To create a focused, independent environment that nurtures the development of new technologies or business models.

- Attracting investment and talent: To draw interest from venture capitalists and top talent attracted to the agility and potential of startup-like environments.

- Increasing shareholder value: Allowing the market to assess the spin-off's potential separately from the parent company, which can often lead to higher value.

- Streamlining operations: To allow the parent company to concentrate on its core competencies by offloading non-core activities to the spin-off.

- Risk management: To manage the risks associated with innovative or experimental projects away from the parent company's balance sheet and reputation.

- Regulatory compliance: To achieve compliance with regulatory requirements.

- Cultivating strategic partnerships: To enable more flexible and strategic collaborations for the new entity outside the corporate structure.

Another potential reason to create a spin-off is the need to divest from underperforming units. Turning them into an autonomous spin-off with its own team and investors increases the chances that the new entity will succeed.

Now that we’ve covered some of the basics, let’s take a look at some of the ways spin-offs can unlock value.

1. Spin-offs facilitate a sharper strategic focus

One of the primary ways corporate spin-offs create value is by enabling the parent company to concentrate on its core activities.

Spinning off a non-core or underperforming venture enables the parent company to concentrate on its traditional core competencies, leading to enhanced operational efficiency and profitability. The same goes for the newly formed entity, which will have more autonomy and space to further develop its own capabilities, regardless of whether or not they align with the parent company’s broader corporate goals.

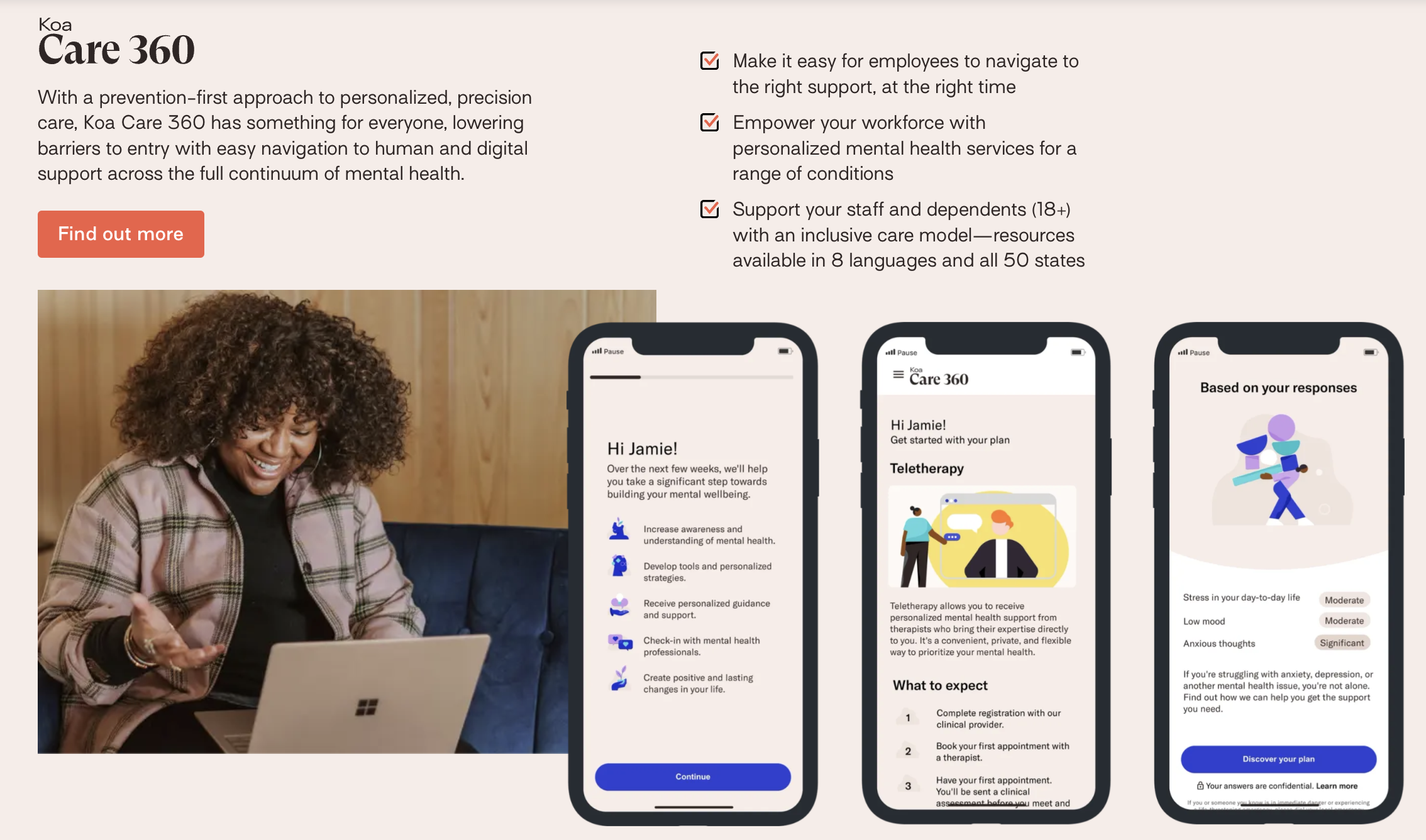

Example: Telefónica and Koa Health

In 2020, Telefónica announced the spin-off of Koa Health, a digital mental health venture that was initially incubated in Telefonica’s innovation hub, “Alpha”. Koa Health’s focus on mental health differed from Telefonica's core focus on telecommunications and digital services. The spin-off gave Koa Health the freedom and flexibility to attract new investments, access additional resources, and pursue tailored strategies specific to the digital health sector.

Shortly after the spin-off, Koa Health secured €14.1 million in funding to expand its operation across Europe, the US, and Asia.

2. Spin-offs have the potential to unlock hidden value.

Spin-offs can unlock the hidden value of a venture that may have been missed or overlooked within the larger parent company.

Spinning-off a seemingly underperforming unit gives it the opportunity to attract new investors, access new resources, and pursue its growth goals more effectively and with more focus. In many cases, the new autonomy can lead to better financial performance, increased market valuation, and higher shareholder returns.

Example: Novartis and DatosX

In 2023, Novartis announced the spin-off of DatosX, a venture designed to vet digital health tech solutions. The inability to back up claims is a common challenge among digital health startups, with only about 20% presenting data they need to convince backers and potential partners. As explained by DatosX co-founder and CEO Robin Roberts:

“What we’re doing with DatosX is allowing for digital health tech to be assessed in a more appropriate manner, so that what gets to patients and HCPs is something of value…”

The spin-off enabled DatosX to expand its impact and unlock new value by working with a wider pool of potential customers (not just the ones that want to partner with Novartis).

3. Spin-offs can boost financial returns for both entities.

The process of spinning-off a venture through a sale or IPO can generate significant financial returns for the parent company, which can be reinvested in core areas or returned to shareholders.

On the other hand, the newly spun-off venture can implement strategies, management structures, and cost controls that are more suitable for its specific business environment. This increases its chances of becoming profitable and attracting interest from new investors.

Example: ING Group and Cobase

ING Group spun off Cobase, a venture that streamlines the banking experience for international corporate customers by offering a platform for accessing accounts across various financial institutions. It also enables them to integrate their own ERP systems into the solution. As explained by Jorge Schafraad, founder and CEO of Cobase:

"Our strategy is to make Cobase a leading pan-European player in the coming years and then continue to roll out globally. We are already connected with more than a hundred banks from all over the world. We simply follow the needs of our corporate clients."

Following the spin-off, Cobase successfully raised €10 million and two new investors (Nordea and Crédit Agricole CIB) to refine its technology, expand its market reach, and further develop its unique value proposition. As a shareholder, ING also stands to benefit from Cobase’s growth and financial success.

4. Spin-offs can help corporations reduce risk.

Spinning off a venture can be a strategic move to help corporations mitigate risk. By separating a new venture into its own entity, the parent company isolates the financial and operational risks of exploring new markets or technologies.

In other words, it ensures that any potential downturns affecting the spin-off do not directly impact the parent company's stability, reputation or performance.

Example: Pfizer and SpringWorks Therapeutics

Spun-off from Pfizer back in 2017, SpringWorks Therapeutics is a commercial-stage biopharmaceutical company that develops treatments for rare diseases and cancer. The spin-out was prompted by SpringWorks Therapeutics’ ambition to move forward with the development of several new rare disease drugs that were outside Pfizer’s scope at the time. As an autonomous entity, SpringWorks had the freedom to pursue these projects with no risk to the parent company.

Shortly after the spin-off back in 2017, Spingworks raised $103M in series A funding to develop new drugs for underserved patients. Most recently, it launched its first FDA-approved commercial product, a drug called Ogsiveo, designed to treat desmoid tumours.

5. Spin-offs can boost innovation speed.

When a venture is spun off, it gains the agility and flexibility to quickly respond to market changes, adjust to evolving customer needs, or incorporate new technologies—speeding up both product development and market entry. This nimbleness can be a game-changer in terms of seizing and capitalising on emerging opportunities, giving the spin-out a first-mover advantage.

Example: Porsche Digital and &Charge

Back in 2020, Porsche Digital spun off &Charge, a digital platform that combines e-mobility with customer engagement through rewards and incentives. Since the spin-off, &Charge has become available in Europe, enabling users in Austria, Germany, the Netherlands and Belgium to get km rewards they can exchange for e-charging credits, car rental credits, scooter rental credits and more.

The example showcases how spin-offs can quickly enter new markets, tailoring their offerings to local customer demands.

Corporate spin-off FAQs

Q. What's the difference between a spin-off and a carve-out?

While both separate business units from the parent company, a spin-off distributes shares of the new entity to existing shareholders, creating a completely independent company. A carve-out involves selling a portion of a business unit to outside investors through an IPO, with the parent typically retaining control.

Q. How long does a typical corporate spin-off process take?

Most corporate spin-offs take between 6-18 months to complete, depending on complexity, regulatory requirements, and the preparation needed to establish the new entity as an independent business with its own operational infrastructure.

Q. What governance challenges do newly formed spin-offs face?

New spin-offs must quickly establish effective governance structures, including assembling a qualified board of directors, implementing compliance frameworks, and creating reporting mechanisms. They must also navigate the transition from being part of a larger organization to establishing their own decision-making processes.

Q. Can spin-offs access the same resources as their parent companies?

Most spin-offs negotiate transition service agreements (TSAs) that allow them to temporarily access certain parent company resources, infrastructure, or services during the separation period. These agreements typically phase out over 6-24 months as the spin-off develops its own capabilities.

Final thoughts

As illustrated in the examples above, corporate spin-offs create value in a variety of ways; however, in most cases, their success will be dependent on a number of factors:

- Strategic goals: Having a clear rationale to create a spin-off, e.g. improved focus, reduced complexity, or enhanced capital allocation, is critical to its success.

- Efficient execution: Proper planning, communication, and execution of the process are essential to ensure a smooth transition and minimise disruption to the entities involved.

- Sturdy governance set-up: The new entity needs a capable management team and an effective governance structure in place to drive growth and succeed in the long run.

- Financial stability: Both the parent company and the spun-off entity should have a solid financial foundation, ensuring they can operate independently and pursue their strategic objectives.

Be sure to carefully consider these factors if you’re thinking of setting up your own corporate spin-off.

_________________

Would you like to launch your own corporate spin-off? We can help you leverage insights gained during your validation initiatives to take your independent venture to scale and beyond.

The Corporate Venture Dilemma: Spin-Off vs Business Unit

Get a clear, side-by-side view of both models, so you can structure your venture for speed, autonomy, and long-term success.

.svg)