Key takeaways

For years now, rapid advances in technology, shifting customer needs and new market entrants have been taking the financial services industry by storm. Convenient, fast, mobile-friendly services that are available 24/7 have become the norm, with great user experiences and cybersecurity topping the long list of customer demands.

The industry has become extremely competitive, with startup providers like N26 and Revolut and established tech providers like Apple Pay and Google Pay moving in with innovative offerings. Established corporations have been quick to respond, investing in their own innovation units. Case in point: Capital One’s The Lab.

For almost a decade, The Lab has been helping Capital One accelerate its digital transformation by developing ventures that explore areas like machine learning, cybersecurity and reimagining traditional credit cards.

Explore our global list of corporate ventures with over 200 examples you can sort by business model, industry, parent company and more!

Let’s take a closer look at how Capital One’s The Lab is incubating, accelerating and investing in the startups that are paving the way for its future.

About Capital One.

Headquartered in Virginia and founded in 1994, Capital One is a diversified banking company with two main segments:

- Local Banking - Which caters to local customers and businesses.

- National Lending - Which consists of three sub-segments:

- Domestic consumer credit and debit card activities

- Auto Finance

- Global Financial Services (lending and financial services)

Having been recognised as one of Fortune’s and PRWeek’s best places to work, Capital One has about 44.550 employees, 750 branches, over 70.000 ATM’s and a revenue of $33,7B (for the last fiscal year).

In 2012, Capital One founded what was then known as Capital One Labs (today it’s The Lab). The goal? To create dedicated spaces throughout the organisation for teams to develop innovative customer-centred ideas and drive Capital One’s digital transformation forward.

Meet The Lab.

Faced with growing demand for better user experiences, convenient processes and effective protection against fraud, Capital One created The Lab to explore the technologies that would address these challenges.

With locations in New York and Washington DC, The Lab incubates, accelerates and invests in startups that heighten the digital banking experience for customers.

Under the mantra “We think big, start small, and learn fast”, they ideated, tested and developed hundreds of initiatives through the years. Some of which include a Capital One Wallet, better overdraft options for customers and the opening of numerous Capital 360 Cafés throughout the US (just to name a few).

Of course, not all ideas will turn into successes that shape the future of digital banking, and the team at The Lab is aware of it. As explained by the Head of The Lab, Jennifer Lopez:

“I always talk to my team about when you work in innovation and new products; you have to be incredibly resilient because most of the fantastic ideas won’t work. In fact, we look at hundreds of ideas annually and shut down 95% to 97% of those ideas.”

This “fail hard and fail fast” mentality has certainly paid off, with a portfolio of successful ventures to back it. Here are just a few:

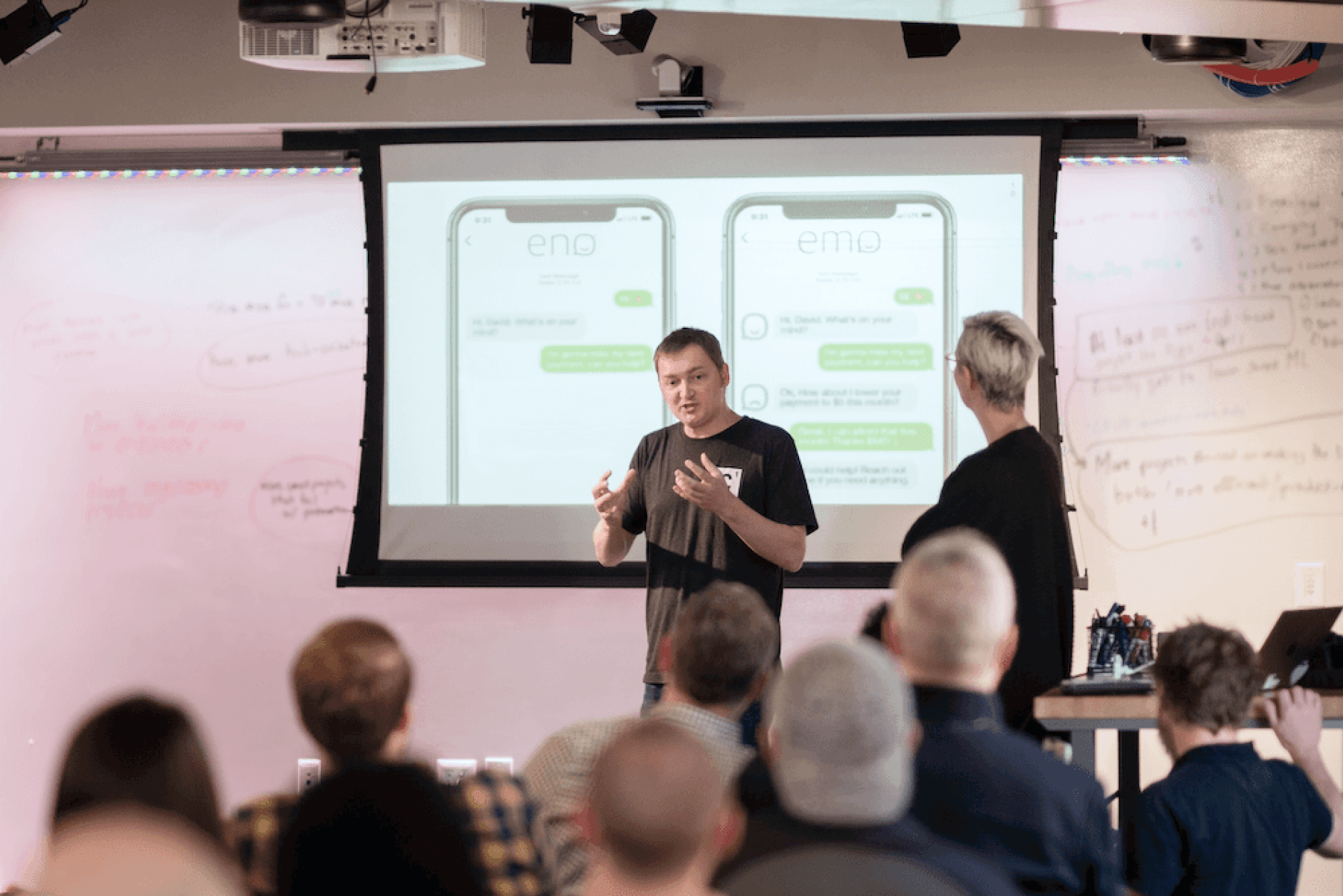

- Eno - a virtual assistant that provides alerts to safeguard your finances.

- Capital One Shopping - A free tool that helps you find deals online.

- Auto Navigator - A free tool that makes car buying and financing easy.

How The Lab works.

Unlike other incubators, The Lab operates as a fully integrated part of Capital One. Most of their venture ideas come from employees, partners, or quarterly hackathons and have practical business applications. As described on the company website:

“Our diverse team knows the ins and outs of the company and understands how to use its strengths to create products and experiences that benefit millions of customers.”

Each promising initiative is explored, tested and iterated to decide whether it moves on to further development or gets scrapped to make room for better propositions. The Head of The Lab, Jenifer Lopez, explained the process in a recent article:

“By discovering all the potential opportunities and pain points, we’re able to glean better insight on what exactly our customers need. We pause at every phase of the customer journey to learn how to make incremental improvements and use cutting-edge innovations to help better customers’ lives.”

What makes The Lab successful?

Here are just a few of the factors that make Capital One’s The Lab a success:

A Customer-centered approach

Every initiative that gets developed at The Lab solves a real customer need or pain point. As explained by Lopez:

“Who we are is a representation of the people who we are trying to serve every single day. We are speaking their stories. It’s what drives us.”

An inclusive environment

One of the main goals at The Lab is to create an environment where team members with different strengths, skillsets and capabilities can work together and get heard. This encourages a free flow of ideas from different points of view, different backgrounds and different areas of expertise. As described by former VP and Head of Product, Steve Strauch:

“By being fully inclusive, we remove barriers that prevent associates from sharing that seemingly crazy idea or speaking up when they disagree – and that empowers our teams to be truly great.”

A strong connection to the mothership

The Lab operated as an integrated part of Capital One. This enables the team to make the best use of existing resources and know the actual gaps, needs, and customer pain points.

Corporate assets

With over 20 years of experience in financial services, operations in the US, the UK and Canada, a global customer base and a strong brand presence, The Lab has some pretty powerful assets to work with.

A “test and learn” mentality

The fear of failure can impede the innovation process and keep disruptive ideas from moving past the proverbial drawing board. The team at The Lab know how to test ideas quickly, make the necessary iterations and gain invaluable insights during the process - regardless of whether the idea gets developed.

What’s next for The Lab?

It’s been almost a decade since The Lab was founded, and the team is still making great strides in its mission to accelerate Capital One’s digital transformation and provide customers with heightened experiences.

In a recent article, Lopez shared her insights on how The Lab kept their hackathons running during last year’s lockdown, noting how a commitment to change, the right tools and taking the time to adjust were paramount.

According to The Lab’s website, the team is currently working on some pretty ambitious projects, including:

- A new machine learning platform to make model development simpler

- Payment tokens to make online shopping more secure

- Developing tools that correlate fraud with other illegal activities

These new capabilities are sure to differentiate Capital One from competitors, attract new customers and provide invaluable insights along the way.

___

Corporate venturing enables you to leverage your existing assets to future-proof your business, accelerate your digital transformation and create new revenue streams. We can help you build a venturing arm that fuels innovation from within by delivering a steady pipeline of profitable new ventures.

60 Corporate Incubators Shaping Our Future

Discover how top corporations use incubators to drive innovation and unlock new revenue streams.