Key takeaways

In the disruptive world of today’s economy, there are only two things that will remain constant: change and, thus, corporate venturing tools and models.

Corporate venturing as a whole is here to stay, and has developed far further than the ‘traditional’ corporate venture capital investments of recent memory. The goal with these new venturing models is to help corporates find more efficient and effective ways to innovate.

Explore our global list of corporate ventures with over 200 examples you can sort by business model, industry, parent company and more!

What is Corporate Venturing?

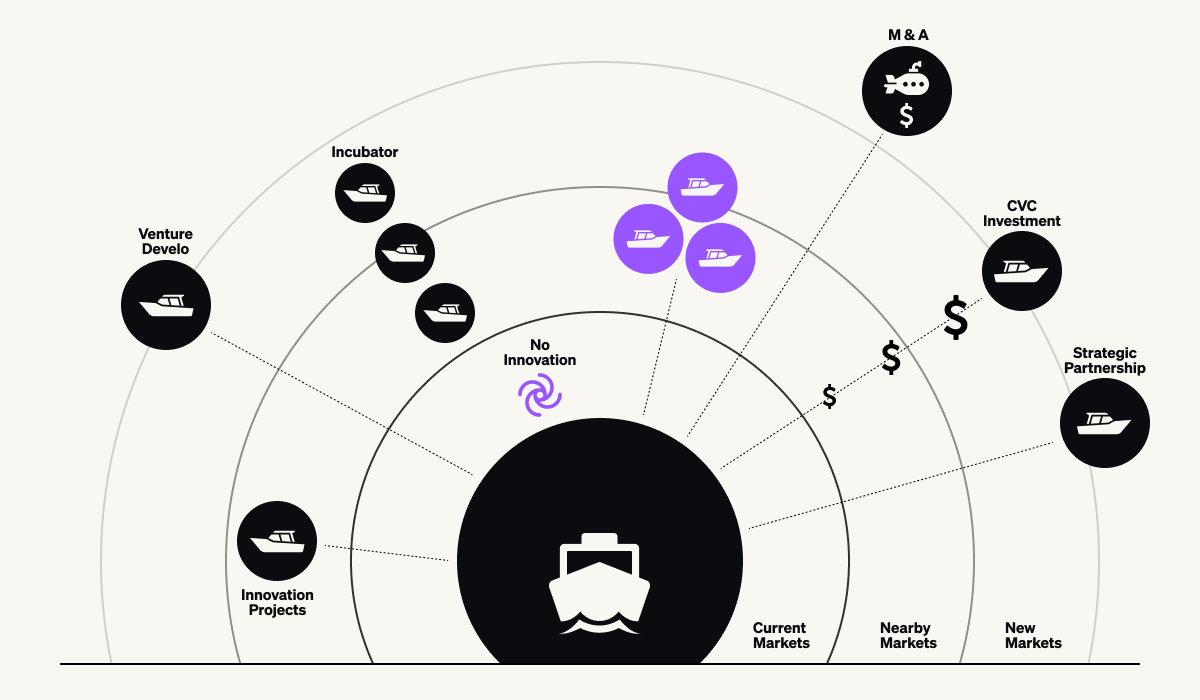

Let’s rewind. We keep using the phrase ‘corporate venturing’, but what exactly does that mean? Corporate innovation models can take many forms. At its most basic, it can purely be a financial investment with a larger company taking an equity stake in a smaller company. This is most often done through a separate fund being set up specifically to invest in startups and growth companies in the same way that a traditional venture capital firm would.

That’s the foundation. So, on to the next point — why should corporates be involved? We wrote a more extensive piece about this before, but to sum it up, our top four reasons are:

- Speed

- New core business opportunities

- A wider market window

- Having low risk vs. high rewards.

How can a company ‘do’ Corporate Venturing? Here are the 16 innovation tools.

So, let’s move on to the many ways in which corporate innovation and venturing can work. We’ve defined 16 different types of innovation tools that a corporate entity can use, some that will increase innovation culture, others that strengthen relationships with startups. We’re going to define all 16 types, and give examples for the six that we feel are most important or useful to corporates. You can find all of this and more information about the corporate venturing landscape in our accompanying SlideShare, which you can download at the bottom of the page.

1. Corporate Venture Capital

Corporations use direct equity investments to target startups of strategic interest.

Ex. In 2015, Spotify raised $115M from Sweden’s largest phone carrier, TeliaSonera, for a 1.4% stake as a joint partnership in innovation with the music giant.

2. Mergers & Acquisitions (M&A)

Established firms purchase startups or young companies and their commercial-ready products in order to access new technologies or markets.

Ex. In 2014, Facebook acquired WhatsApp for $19B. Why? The answer is probably user growth. Over 500 million people used WhatsApp monthly at the time and added more than 1 million users per day.

3. Corporate Accelerator

Corporate accelerators offer highly structured programs that typically last no more than three months. These programs provide startups that do not yet have proven products or services with the facilities, resources, and expertise needed to speed their product development and time to market.

Ex. In 2015, Rainbird was the only British company selected for the MasterCard Start Path 6-month program. MasterCard has partnered with Rainbird to implement the latter’s artificial intelligence technology.

3b. Corporate Accelerator Partnership

These partnerships offer the same advantages of regular corporate accelerator programs, but are run in partnership with external parties that have the blueprints for the program.

Ex. In 2016, Jaunt VR was presented at the demo day of the Disney Accelerator program, powered by Techstars.

4. Corporate Incubator

This includes mentoring and value-added services to support entrepreneurs building viable, market-ready ideas. A corporate incubator starts even before the idea is created.

Ex. Coca-Cola Founders empowers startups from scratch to scale-up, like Home eat Home. The startup’s success is a win for Coca-Cola as an investor, gives them access to new markets, and lets them leverage their assets in new ways.

4b. In-House Incubator

In-house incubators function as startups within a corporate setting. Teams of in-house innovators, or intrapreneurs, convene for short projects, during which they rapidly prototype new products or services with the aim of market testing a minimum viable product by the end of the project. In-house incubators do not involve the R&D department.

Ex. Google is setting up Area 120 to birth companies from intrapreneurs. “Area 120 is a new approach, part incubator, part new take on the spirit of the 20% time program,” says CEO Sundar Pichai.

5. Venture Development Studio

A venture development studio, startup studio, company builder or venture builder, is a structure that creates startups based on shared resources and a multidisciplinary team. It provides Startup as a Service.

Ex. Bundl launched Horizon with an undisclosed consumer bank in 2016. Bundl is a venture development studio teaming up with corporates to create new ventures from scratch and tackle new markets together. Stay tuned for exciting announcements coming soon!

6. Strategic partnerships

Alliances between established corporations and startups can take many forms — including the co-development of products and services.

Ex. In 2015, Adidas partnered with Spotify to launch Adidas go.

7. Hackathon

A focused workshop where software developers come together to collaboratively find technological solutions to a corporate innovation challenge.

8. Acqui-Hire

Acqui-hiring is the process of acquiring a company to recruit its employees, without necessarily showing an interest in its products and services — or their continued operation.

9. Sharing Resources

A means to grant startups access to resources while the established corporations get closer to the entrepreneurial ecosystem.

10. Excubator

This structure lets development studios use their own external team to carry out venture projects on behalf of a third party, individual or company.

11. Entrepreneur-In-Residence

An Entrepreneur-In-Residence is an informal and usually temporary position at the corporate venture capital arm of the company. EIRs introduce organizations to new business models, technologies, and strategic partnership opportunities. EIRs build bridges into the startup community.

12. Challenge Prize

An open competition that focuses on a specific issue, offering an incentive to field innovators to develop the best solution.

13. Scouting Mission

The established company appoints an individual within a given industry to scope out innovation opportunities in alignment with the corporate strategy.

14. Employee Jurors/Mentoring

These team members participate in startup competitions to spot emerging technologies or business models early.

15. Corporate University Partnerships

Collaborations between corporate R&D departments and university researchers to find promising ideas for further development and investigation.

16. Licensing

This enables corporations to apply innovations developed by startups to new markets, industry sectors and customer segments.

How to Choose the Right Venturing Tool?

With so many options, choosing the way forward that fits your needs can be difficult. We’ll be reviewing how to find your way forward in our next blogpost.

Why are we writing about corporate venturing like this? At Bundl, we practice what we preach. We provide SaaS to our clients, but we’re not an agency. We’re not even innovation consultants. We are entrepreneurs teaming up with corporates to create new ventures together.

Make sure to read more about the advantages of corporate venturing.

---

Build your corporate venturing strategy with us and speed up your innovation process.

16 strategies for disruptive innovation.

These 16 corporate venturing tools will help you innovate at startup speed.