Key takeaways

As technologies continue to advance, portfolios become outdated, and new players enter the market, Corporate Entrepreneurship has emerged as a tried and tested way for enterprises to thrive amidst disruption.

By leveraging their corporate assets to create, build and scale cutting-edge businesses, these forward-thinking companies are innovating from the inside out. Each venture presenting a new opportunity to test promising business models, expand beyond core offerings and broaden their digital capabilities in out-of-the-box ways.

Today, Corporate Entrepreneurship has become a staple in the culture of leading corporations around the world and across almost every industry, enabling companies to:

- Create new revenue streams

- Tap into new markets

- Compete more effectively

Not to mention advance their corporate agenda faster, more flexibly and more cost-effectively (e.g. Goldman Sachs, Rabobank, AstraZeneca).

To help you better understand how Corporate Entrepreneurship works, why it’s important and what the latest trends are, we’ve compiled a list of ten important stats every Corporate Entrepreneur should know.

1. 40% of today’s leading corporations will be dead in ten years.

Source: Innovator News

This was a somewhat grim prediction made by former Executive Chairman and CEO of Cisco, John Chambers, during a keynote speech in front of 25.000 attendees. He went on to describe how:

“70% of companies would attempt to go digital, but only 30% would succeed”.

The prediction highlights the importance of digital transformations in today’s fast-moving and highly competitive corporate landscape. When asked to elaborate on this point in a recent interview, he explained that there are three main reasons why so many companies fail to adapt successfully:

- They make slight tweaks to the agenda and expect vastly different results.

- They make too many lateral moves in a landscape where you either “grow or die”.

- They take too long to establish a “digital-first mindset”.

It all boils down to the importance of innovation, not just incrementally, but by making radical, bold moves to prepare for the future.

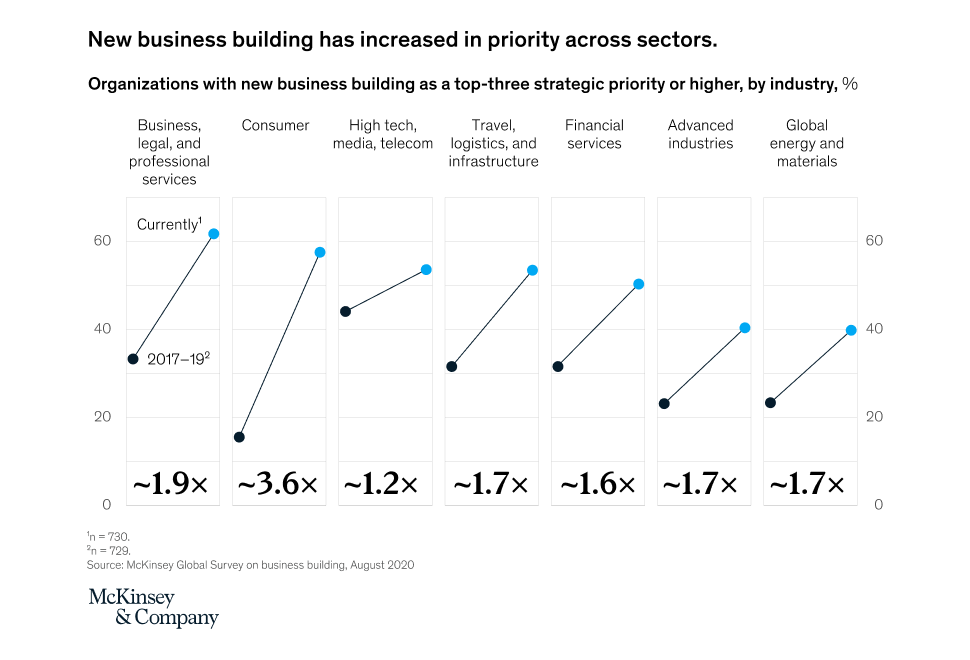

2. 74% of companies that chose venture building as their main strategy grew faster than their peers.

Source: McKinsey

Venture building is an important tool in the arsenal of most corporate innovators. As described in a recent report by Mckinsey, it’s:

“become more important for incumbent companies looking to use innovative business models, products, and services to meet the threats and opportunities of a digitising world. The COVID-19 crisis has accelerated and intensified that trend.”

Many of the companies in the study are investing about a third of their organic growth budget in building promising new ventures, and the trend isn’t limited to just a few industries:

3. 80% of corporations would like to work with or learn more about startups.

Source: Wired

This was one of the findings described by Accenture’s former Head of Growth and Strategy Narry Singh. He explains the difficulties faced by large corporations that try to achieve meaningful innovation using their existing structures. In the article, he goes on to explain that these efforts don’t work because:

“...firms are still too slow to move and change their working practices. Throwing money at innovation schemes doesn't mean they will be successful.”

Instead, he advocates for a collaborative approach between corporations and startups, where established companies invest, scale and co-develop innovative ventures to help reach their growth goals.

4. About 42% of innovations fail due to prolonged development times.

Source: Forbes

According to Abdo Riani, Founder and CEO of VisionX Partners and Senior Contributor at Forbes:

“Most innovations fail because entrepreneurs invest more resources to improve a product without involving the customer and testing their willingness to pay and use it.”

Having reliable evidence before you make any big investments in a new venture can be a lifesaver in terms of reducing risk and saving valuable time, money, and resources. After all, who wants to put a product into the market only to find out months later that it isn’t commercially viable? Early validation can help you avoid making this rookie mistake.

5. Companies that launched at least four new ventures in the past ten years are over 50% more likely to generate returns.

Source: McKinsey

Practice makes perfect. So it isn’t surprising that more seasoned entrepreneurs with a few ventures under their belt would learn to recognise favourable market conditions and avoid rookie mistakes. Each new venture (even the ones that fail) provide valuable insights and learnings that can be leveraged to strengthen your next big project.

6. Top emerging industries to invest in include AI, virtual reality, renewable energy, cybersecurity, big data and cloud computing.

Source: Forbes

Here are a few interesting stats about these emerging industries:

- The VR market is expected to reach $162,71 B, at a CAGR of 46% from 2021 to 2025.

- 72% of executives believe AI is going to be a business advantage to them in the future.

- The global cybersecurity industry is forecast to reach $170,4 B by 2022.

Corporations all over the world are choosing to invest in these emerging industries as a way to diversify their portfolios, create new revenue streams and experiment with new tech and business models. For many of these companies, the results have been stellar - exceeding expectations in terms of profits and providing a myriad of valuable learnings (e.g. Google’s AdLingo, L’Oréal’s Color&Co, Telenet’s The Park Playground).

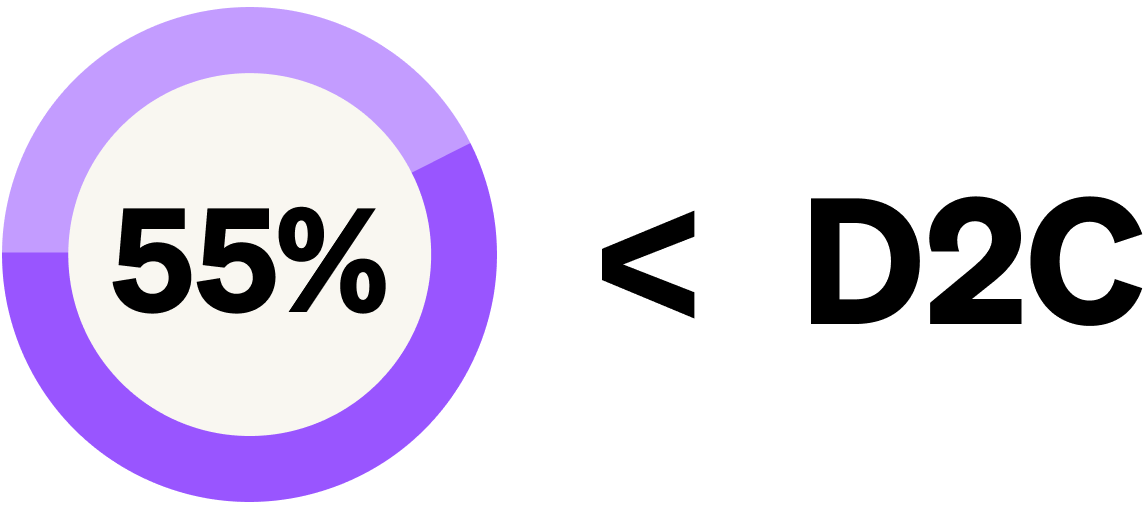

7. 55% of consumers prefer to buy directly from the brand (D2C) over a third-party retailer.

Source: Invesp

The D2C model has been on the rise for over a decade now, led by pioneers like Casper, Away, and Bark Box, who leveraged it to become the legendary unicorns they are today. Since then, the trend has spread like wildfire, surpassing the startup world to become a prominent fixture in the corporate realm. Here are seven inspiring examples of how companies like Disney, Heinz and Comcast are exploring D2C with amazing results!

With about a third of U.S. consumers planning to do 40% of their shopping from D2C brands in the next five years, it safe to say we’ll be seeing more D2C activity in the future.

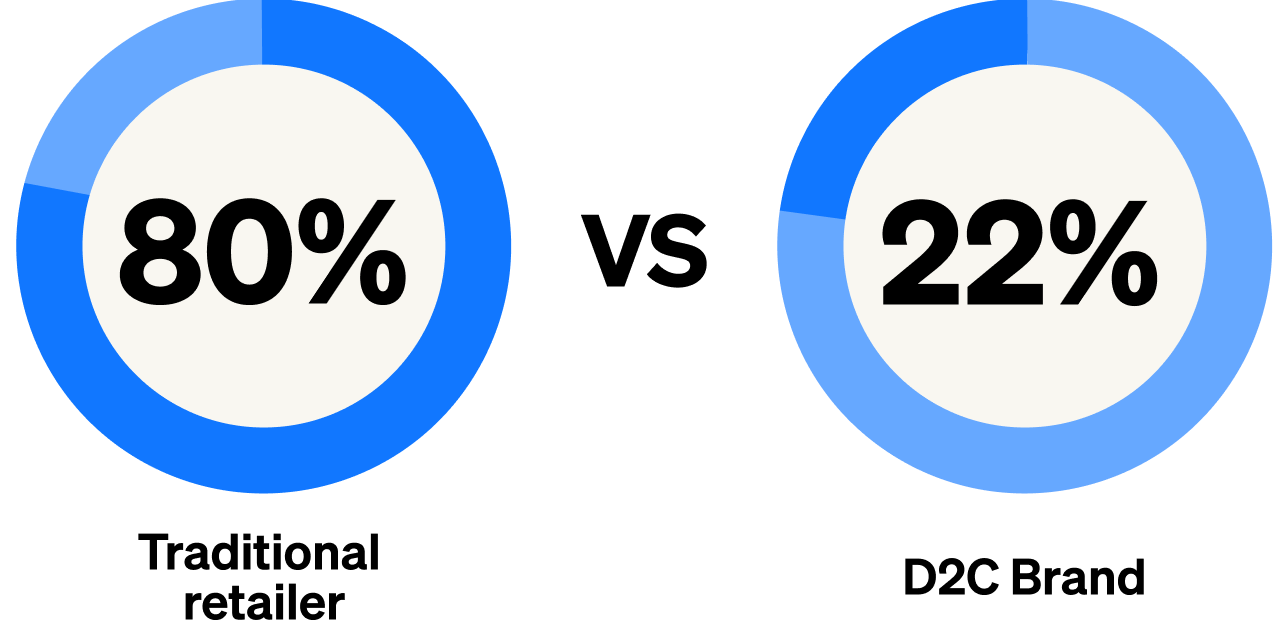

8. Only 22% of D2C brands reported sales declines since the pandemic, compared to 80% of traditional retailers.

Source: Forbes

This reflects some of the extreme shifts in customer behaviour that have taken place in the last few years and were accelerated by the Covid Pandemic. PantryShop by PepsiCo is another great example of how a corporation can successfully explore the D2C model with excellent results.

9. The market for Pay-per-Use (PPU) and Equipment as a Service (EaaS) was $21,6 B in 2019 and is expected to have a CAGR of 35% over the next years.

Source: Findustial

Under the pay-per-use model, the ownership and responsibility of the product/service lie with the provider, and customers pay a fee for usage on demand. Many customers prefer this model because they like the idea of paying only for the services they require and use. In many cases, they also receive better service because the manufacturer has a greater interest in providing a product that lasts.

With the rise of IoT, tracking the usage of products has become easier, more accessible and more accurate than ever. This new data flow has made pay-per-use a more viable option for industries that previously didn’t have the tech capabilities to gain value from it.

10. 80% of consumers are more likely to purchase when brands offer personalised experiences.

Source: SmarterHQ

Offering a superior and personalised customer experience makes customers more likely to develop trust, loyalty and recommend the product or service to others. On the flip side, around 50% of customers report that even one bad experience is enough to make them switch brands.

This challenge can be tackled by putting careful thought into building your customer journey and validating it early on in the process.

Final thoughts

The rewards of corporate venturing can be quite vast in terms of growth, innovation and profitability, but it’s not a risk-free process. It requires careful planning, preparation and an entrepreneurial mindset to execute successfully.

Working with the right tools, technology and talent go a long way in helping you overcome the risk and get the returns you’re looking for.

____

Would you like to leverage your corporate assets to build a venture strategy that delivers new revenue streams for the future? We can help you future-proof your business with just the right venturing mix.

5 successful corporate startups examined.

We take a deep look into how 5 corporate startups found success.