Corporate venturing: An introduction

New startups are sprouting up every day, bringing new value to the market and disrupting the status quo with cutting-edge innovations, new technologies and AI-driven business models. For established corporations, this means having to compete not just with traditional industry rivals but with agile, tech-enabled startups with the potential to disrupt entire markets overnight.

The result?

- Product lifecycles have compressed from years to months

- Customer expectations are continuously evolving

- Technology adoption curves are steeper than ever

- Industry boundaries are becoming increasingly blurred

In response, corporations all over the world are turning to corporate venturing as a strategy to:

- Access to new technologies and business models

- Explore new growth opportunities

- Grow beyond their core capabilities

- Future-proof the business and maintain a competitive edge

To give you a better idea of how corporate venturing works in practice, we created this guide highlighting the benefits, challenges, real-world examples and pro tips to inspire your corporate venturing journey.

What is corporate venturing?

Corporate venturing is a proven innovation strategy in which companies build, buy, or partner with external startups to drive growth beyond their core business. The approach brings together the best of both worlds—the resources, scale, and expertise of established corporations with the speed, agility, and innovative mindset of startups.

Each new venture acts as a new "growth engine" that can operate outside traditional corporate constraints, testing, validating, and scaling new opportunities and enabling companies to quickly and efficiently explore new areas with controlled risk.

Now that we’ve covered the basics let’s take a closer look at how corporate venturing can help you leverage your assets, reach new markets, discover new technologies, and adapt your core strategy to better meet today’s market challenges.

Corporate startup vs independent startup: What's the difference?

Corporate ventures and independent startups share many characteristics—like rapid innovation and agile development—but operate in fundamentally different ways. Let’s take a look at some of the key differences:

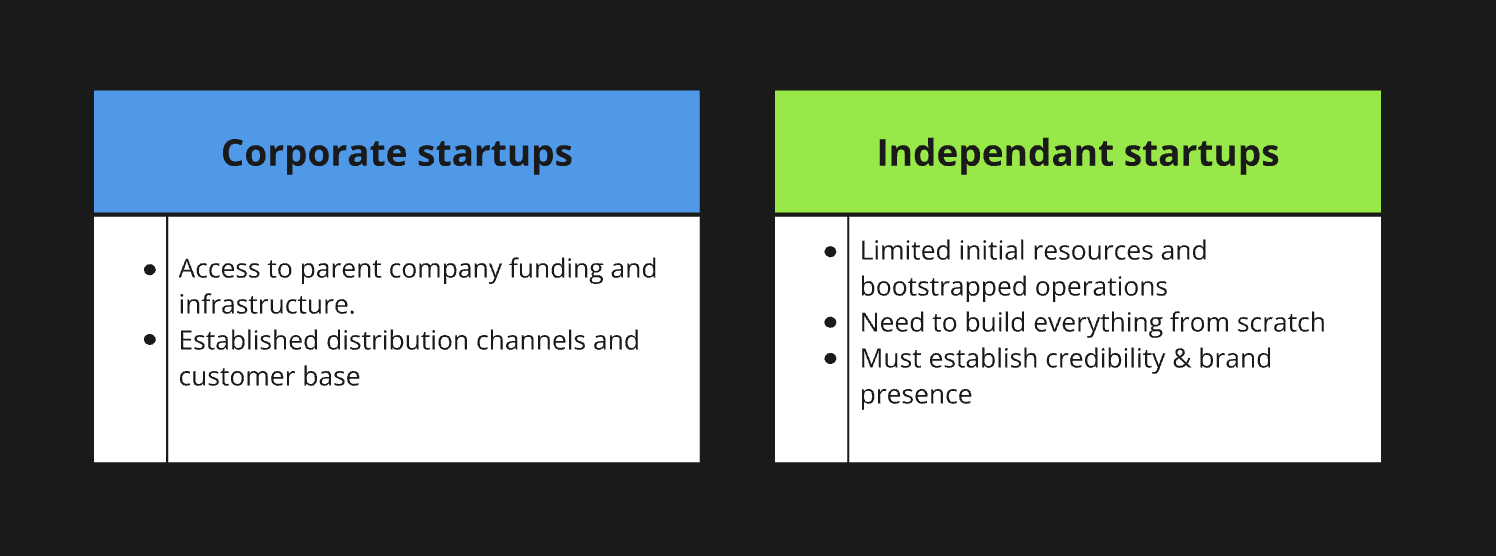

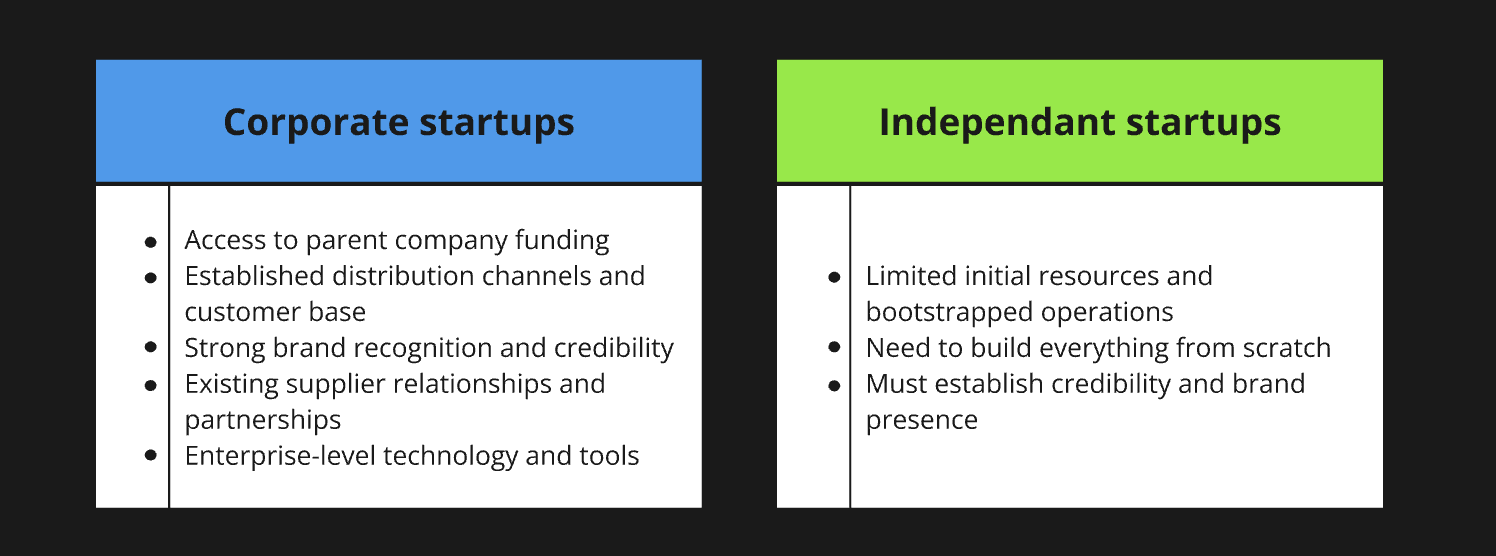

Resources and infrastructure

Decision Making

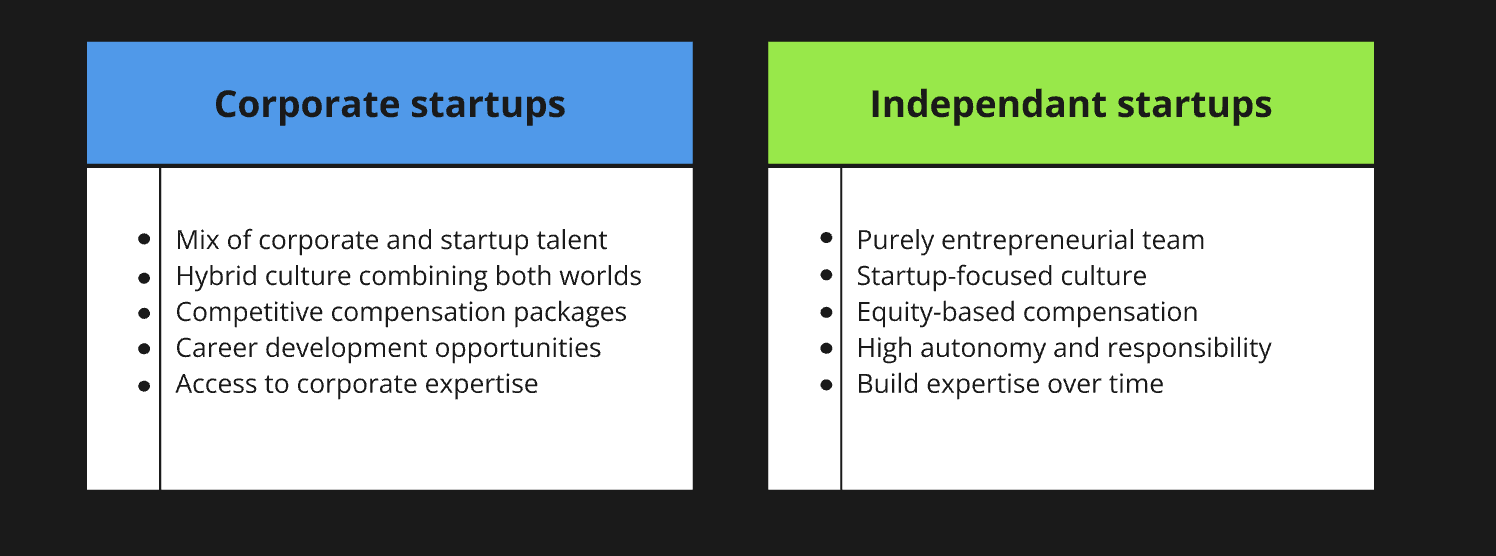

Talent and culture

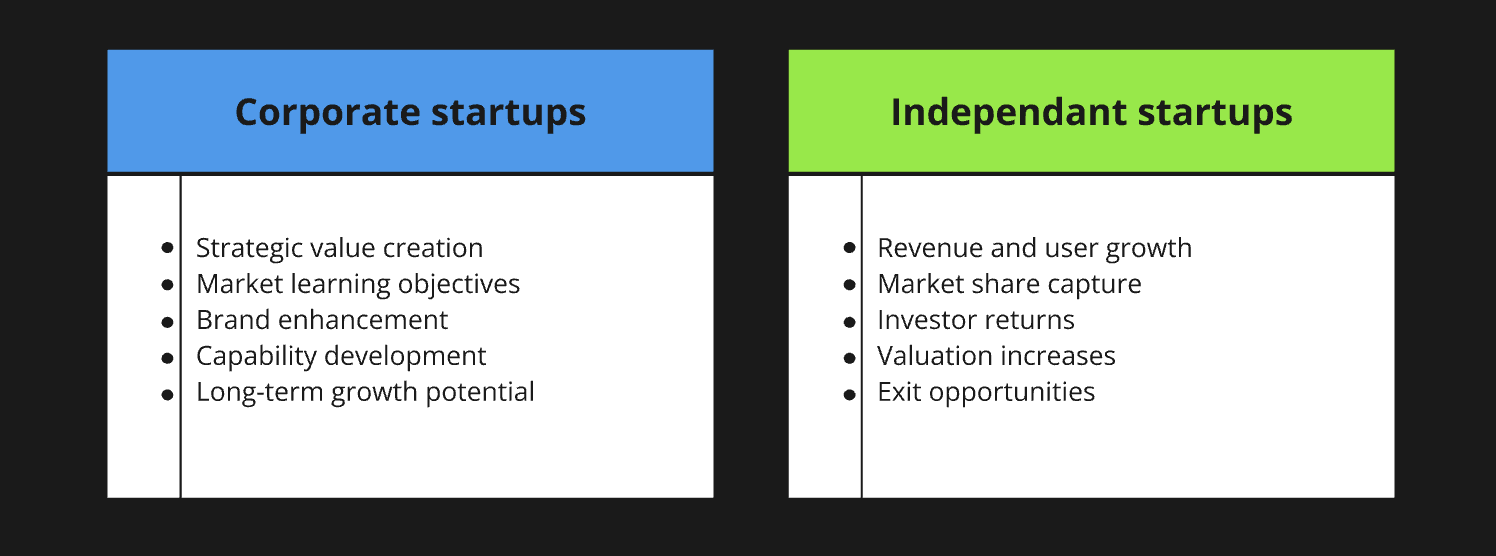

Success Metrics

How does corporate venturing boost corporate innovation?

To answer this question, we’ve listed some of today’s most common innovation challenges and how you can use corporate venturing to overcome them:

1. A lack of agility

Everyone wants to be the first to take advantage of new growth opportunities (i.e. adopting a new technology or business model or putting out a new offering), leaving competitors in the dust. This can be a challenge for corporations with strict rules and hierarchies that prevent fresh concepts from moving past the proverbial drawing board.

How corporate venturing can help:

Corporate venturing helps enterprises bypass all the regulations and high chains of command by investing in independent ventures. This enables them to experiment with new technologies, offerings and business models, quickly and efficiently, the same way startups do.

2. Limited access to new technologies

Testing out new technologies is hard within corporations because of their sheer size and the potential risks involved in making big changes at that scale.

In addition, many corporations lack the know-how, initiative and exposure to technologies that can potentially revolutionise their industries. It’s a huge missed opportunity that smaller players can exploit to steal market share and gain a competitive edge.

How corporate venturing can help:

Startups are renowned for accessing, utilising and producing next-generation technologies. Corporations that build their own startups have direct access to these new technological advances, which can be leveraged to stay ahead of startup competitors.

3. Outdated customer experiences

What people consider to be a good customer experience is changing as quickly as the markets are. Customers are placing less value on actual products and leaning more towards companies that offer memorable experiences. This is becoming an increasingly significant trend as younger generations gain spending power (e.g. .

How corporate venturing can help:

Corporate startups are a great way to experiment with new customer experiences without hurting your brand. Their small, flexible nature enables them to test out different growth marketing, branding and selling strategies to quickly pinpoint what works and weed out what doesn’t.

4. Trouble accessing new markets

Large enterprises that have built their success on meeting traditional customer demands can have difficulty reaching and connecting with younger generations. These days it’s all about convenient digital offerings, customised experiences, and a story that reflects the customer’s values (e.g. minimalism, sustainability, eco-friendliness, etc.).

How corporate venturing can help:

Corporate venturing can help you bridge the generational gap with new business models, messaging and digital offerings.

5. Difficulty testing and validating new concepts

There are plenty of lean and agile ways to test new concepts, including smoke testing, customer interviews and online surveys. The challenge is that many corporations have not yet optimised their approach and are still doing R&D the old-fashioned way (e.g. telemarketing). This can be highly expensive and inefficient.

How corporate venturing can help:

Corporate ventures are a highly effective way to test out new ideas and concepts. They work like sounding boards, validating new technologies, products and services in small, controlled environments.

What are the benefits of corporate venturing?

Corporate venturing is the key to speeding up innovation and financial growth in a rapidly changing market driven by disruptive startups. We’ve outlined some of the benefits below:

1. Speed

Large corporations tend to be constrained by long chains of command and slow-moving decision-making processes, especially when it comes to out-of-the-box changes. This makes it challenging for them to innovate at the same speed startups do. Corporate venturing enables large companies to explore new opportunities with the same flexibility, autonomy and agility as startups.

2. Non-core growth opportunities

Many promising ideas in corporations are written off as “irrelevant because it’s not our core business”. This leaves companies clinging to outdated offerings that could soon be made irrelevant by disruptive startups. This can stifle growth and keep companies from adapting in a market where:

- Emerging technologies are transforming our landscape

- Traditional industry boundaries are blurring

- Customer expectations are rapidly evolving

Corporate venturing enables companies to explore new growth spaces, create new revenue streams and leverage new technologies to compete more effectively.

3. Strategic market intelligence

Exploring new growth opportunities often yields valuable insights about existing or emerging markets. This direct market engagement creates a continuous learning loop that helps companies anticipate change rather than react to it:

- Better understanding of evolving customer needs and behaviours

- Identifying potential disruption threats to the core business early

- Building an ecosystem of innovative startups and potential partner

- Testing new technologies and business models in real market conditions

This gives companies a competitive edge and enables them to better serve their customer of tomorrow.

4. High rewards with low risks

Launching corporate ventures enables companies to test new ideas in a lean, controlled setting. This is considerably less risky than testing a new concept, technology or business model company-wide, where it can be costly and damage the brand. Ideas and concepts that work can be rapidly scaled, and those that fail can be shut down with no real damage to the mothership.

5. Talent and capability development

Companies that engage in corporate venturing tend to appeal to entrepreneurial-minded talent, who are attracted to fast-paced environments where creativity and resourcefulness are valued. In addition, the process of exploring and experimenting with new technologies, offerings and business models enables companies to develop new skills and expertise, providing a significant competitive edge.

6. Ecosystem building

Corporate venturing enables companies to build and participate in powerful innovation ecosystems that extend far beyond traditional industry boundaries. By actively engaging with startups, accelerators, and other innovation players, companies can:

- Access cutting-edge technologies and expertise

- Form strategic partnerships with emerging players

- Tap into new talent pools and ideas

- Share risks and resources across partnerships

This can help companies go from isolated players into connected innovation hubs, creating multiple pathways for growth.

What are the challenges of corporate venturing?

When it comes to corporate venturing (or any strategy for that matter), it’s imperative to anticipate the bottlenecks and have ways to overcome them efficiently. To help you do that, we’ve listed some common corporate venturing challenges and their simple solutions:

Challenge 1. Choosing the right venture.

Many corporations have trouble identifying the right criteria to choose their ventures. This will inevitably lead to difficulties down the road, like not getting the expected returns or not using the right tools to develop the venture.

The solution:

A good rule of thumb to avoid running into this challenge is to make sure your venturing arm is laser-focused on the company’s long-term growth goals, targets and resources. Build your decision criteria based on the corporate assets you can leverage as an unfair advantage.

Challenge 2. Balancing venture speed and corporate governance

Corporate assets like partnerships, expertise, funding, and other resources are vital for any successful corporate venture because they give you an advantage over competitors.

The problem is that it’s not always easy to leverage the necessary assets at the speed required by the startup. Corporate governance delays can cause the new venture to lose momentum and not reach its growth targets on time.

The solution:

The best way to address this challenge is to get ahead of it with proper planning and communication. A venture board can also be of great help, operating as an added layer around the team to ensure their success.

Challenge 3. Using the right incentives

Successful ventures require a leadership team that is resourceful, driven, motivated and above all, entrepreneurially minded. They need to have the proper incentives to go the extra mile and genuinely feel invested in their projects. Many corporations struggle to find the right incentives, which can be detrimental to the venture’s long-term success.

The solution:

Avoid this challenge by daring to incentivise your leadership team with the right legal entity setup and personal incentives. Use KPI-driven bonus models or offer equity shares.

Challenge 4. Managing customer data

Customer data has become an extremely precious resource. When efficiently leveraged, it can help you customise your offerings, improve your customer experience, increase sales, connect with your target audience and add useful features to existing products.

The problem is that even with all the available technology, we’re still having trouble collecting, analysing and securing it.

The solution:

Here are a few useful tips to help you manage your corporate venture’s customer data:

Know what you want to achieve with your data

Make the most of your data by linking it directly to your strategy. Remember, each objective you set at any phase must be measurable.

Make security a priority

According to IBM Security, the average cost of a company data breach globally is $3,86m (not counting the loss in customer trust). Take these steps to secure your data:

- Use a Customer Relationship Management (CRM), Customer Data Platform (CDP) or Data Management Platform (DMP).

- Invest in a data backup system.

- Make sure your employees are trained and certified to handle confidential data (GDPR).

Make sure your data is updated and accurate

Customer databases can quickly become cluttered, outdated and incomplete, leading to inaccurate conclusions during analysis. Take steps to prevent it.

Challenge 5. Ecosystem positioning

A business ecosystem is a set of companies that complement each other by:

- Supplying products for those in the ecosystem.

- Combining their offerings to create new value for the customer.

- Providing different ways to reach customers.

The challenge is that it can be hard for new ventures to position themselves in an ecosystem and collaborate/partner/plugin into these complementary networks.

The solution:

Figure out what goals best fit your company’s capabilities:

- Is your goal to accelerate growth?

- Create new offerings?

- Build end-to-end solutions?

Once you know that, you can start working towards your goals by establishing the right strategic partnerships and bringing in the entrepreneurial talent needed to move your agenda forward.

2 winning corporate venture examples

To give you a better idea of how corporate venturing works in practice, here are two examples of ventures that are helping their parent companies innovate from within:

1. Verizon's Visible

Headquarters: US

Industry: Telecom

Founded: 2018

Visible is a digital-first wireless carrier offering unlimited data, minutes, and messaging services for a flat monthly fee with no physical stores, contracts, or hidden fees.What makes this a successful venture?Through research and co-creation with customers, Verizon created Visible as a separate venture that:

- Reaches new customer segments with a digital-native approach

- Operates with startup agility while leveraging Verizon's infrastructure

- Creates direct customer relationships through D2C channels

- Provides valuable insights about digital-first service delivery

- Competes effectively in the growing digital carrier market

2. Disney+

Headquarters: US

Industry: Digital Entertainment

Founded: 2019

is a direct-to-consumer streaming service that has transformed how Disney delivers entertainment to its global audience, reaching over 150 million subscribers in just a few years.What makes this a successful venture?Building Disney+ as a venture enabled Disney to:

- Build direct relationships with consumers, bypassing traditional distribution channels

- Test new content delivery channels and user experience

- Compete effectively with tech-native streaming services

- Create new revenue through subscription-based models

The platform is also a treasure trove of valuable insights, enabling Disney to learn more about its customer’s viewing habits and preferences.

For more inspiring examples, be sure to check out our report: 50 Corporate Venture Examples.

Successful D2C corporate ventures: Case studies and examples

With more people than ever shopping online and directly from vendors, making a D2C pivot is a smart move - and there’s no better time than now to start innovating. Experimenting with your own corporate startup is a low-risk way to test how the D2C business model can benefit your business.

To give you a better idea of how you can use corporate venturing to explore D2C, here are two examples of industry leaders that have done just that:

PepsiCo with PantryShop

PantryShop enables users to order snack kits with PepsiCo products like SunChips, Quaker Oats, Gatorade and Tropicana. The kits come in different categories, including Rise & Shine, Protein, Snacking, Workout & Recovery, and Family Favorites, and pricing varies from $29,95 to $49,95. Free shipping is standard, and purchases are mobile-optimised to provide a seamless and convenient customer experience. The initiative was taken from concept to execution in less than 30 days by leveraging Pepsico assets like know-how, inventory, customer insights and technology.

Key Takeaway

Pepsico noticed their customers were having trouble accessing their products when the pandemic started - so they created a way to supply customers directly. The D2C model provided a low-resource structure for them to meet customer needs more efficiently.

Amazon with One Medical

One Medical is a membership-based primary care platform that combines in-person care with digital health services. For $199 annually, members get access to same-day appointments, 24/7 virtual care, and a seamless digital experience for everything from booking appointments to accessing health records.

The service represents Amazon's strategic move to bring its customer-centric approach to healthcare delivery. Through One Medical, Amazon offers a D2C healthcare experience that bypasses traditional healthcare channels, making primary care more accessible and convenient.

Key Takeaway

By acquiring One Medical, Amazon was able to enter the healthcare space and explore a direct channel to consumers for healthcare services. This venture is enabling them to leverage their expertise in customer experience and digital services to transform how people access healthcare services while gathering valuable insights about consumer behaviour.

What types of corporate venturing tools are there?

There is a diverse array of corporate venturing tools to choose from, each designed to help companies accelerate growth and boost innovation in unique ways. Here are some of the most common:

Corporate Incubators

Key objective: Internal innovation development

Venture stage: Ideation to MVP (Pre-seed)

Examples: BASF’s Chemovator, Bosch’s Grow

Corporate incubators are independent business units within a corporation that support new ventures from concept to MVP launch. They leverage a company’s corporate assets to support employees or external entrepreneurs by providing mentoring, networks, infrastructure, funding and other resources they need to develop new products, services, or business models.

Key benefits include:

- Complete control over the direction of the venture

- Protection of intellectual property (IP)

- Direct alignment with corporate strategy

- Building internal innovation capabilities

Corporate Accelerators

Key objective: Fast exposure to external innovation

Venture stage: Early stage (Seed to Series A)

Examples: The Accelerator by Nestle R+D, Salesforce Accelerate

In a nutshell, corporate accelerators are programs that support the development of growth-stage startups by providing resources like mentoring, expertise, access to partners, office space, funding and more. These resources can significantly boost a startup's development, enabling it to mature faster, refine its business model, and gain a competitive edge in its market.

Accelerator programs are typically time-bound, lasting anywhere between three to six months, although the duration can vary based on the specific goals and structure of the program.

Key benefits:

- Quick access to emerging technologies and trends

- Limited financial commitment

- Creating an innovation ecosystem

Venture Studios

Key objective: Agile venture building

Venture stage: Ideation to Scale (Pre-seed to Series A)

Examples: X, The Moonshot Factory by Alphabet, InMotion Ventures by JLR

Venture studios, aka startup factories or venture builders, specialise in building ventures from scratch. Unlike traditional incubators or accelerators, they take a more hands-on approach to venture building, with blended, multidisciplinary teams of experienced entrepreneurs, designers, content creators, marketers and growth marketers working together to ideate cutting-edge business ideas and turn them into profitable businesses.

They’re often involved in every venture phase, from concept development to scale, taking on different tasks, including product development, validation, marketing, fundraising, talent acquisition, and more. For more real-world examples, be sure to check out our report: 16 Corporate Venture Studio Examples.

Key benefits:

- Active involvement in venture creation

- Higher success rate than traditional approaches

- Ability to scale ventures quickly

- Shared resources across the portfolio

Corporate Venture Capital (CVC)

Key objective: Strategic investment and learning

Venture stage: Growth stage (Series A to Series C)

Examples: Porsche Ventures, Rabo Investments

CVCs are dedicated investment funds set up by corporations to take equity stakes in promising startups. They combine financial returns with strategic benefits, allowing companies to gain insights and access to new technologies while participating in potential upside.

Key benefits:

- Financial returns alongside strategic value

- Portfolio approach to innovation

- Access to emerging technologies

- Market intelligence gathering

- Potential acquisition pipeline

Venture Client Units

Key objective: Fast pilot implementation

Venture stage: Market-ready solutions (Post-seed)

Example: BMW Startup Garage

Venture client units focus on becoming early adopters of startup solutions, acting as strategic first customers rather than investors. They help startups validate their products in real market conditions while helping corporations implement innovative solutions quickly.

Key benefits:

- Fast implementation of innovative solutions

- Lower risk than equity investments

- Real-world validation of new technologies

Other commonly used innovation tools include mergers & acquisitions (M&A), strategic partnerships, hackathons, corporate university partnerships and licensing agreements.

The key is choosing the right tool or combination of tools for your company, will depend on your own unique set of:

- Innovation goals and targets

- Resource availability

- Risk appetite

- Time horizon

- Internal capabilities

How to choose the right corporate venturing tool

Now that you know more about your corporate venturing options, it’s time to identify which innovation tools work best for your organisation. Start by identifying your corporation’s higher-level objectives (i.e. the goals you want to reach) using the handy corporate objectives chart below:

Once you’ve done that, you can use the guide below to find out which tool would be most effective in helping you reach your specific objectives:

Ecosystem

Companies seeking an ecosystem objective need tools that can create an effective platform for startup engagement. We recommend tools like accelerators, events, and sharing resources.

Culture

Is your team or corporate structure lacking a startup mindset? To boost the entrepreneurial spirit within the office, corporates should choose tools that will help rejuvenate their corporate culture. To achieve this goal, we recommend incubation and sharing resources.

Innovation

If your main objective is to reach adjacent markets with modest change, use tools suited for incremental innovation. We recommend strategic partnerships, accelerators, incubators, and venture development studios.

New markets

Ready to get radical? If your goal is to venture outside your core business, we recommend a tool aimed at seeking out new sectors or target groups. Corporate venture capital investment, M&A, and venture development studios are all great choices.

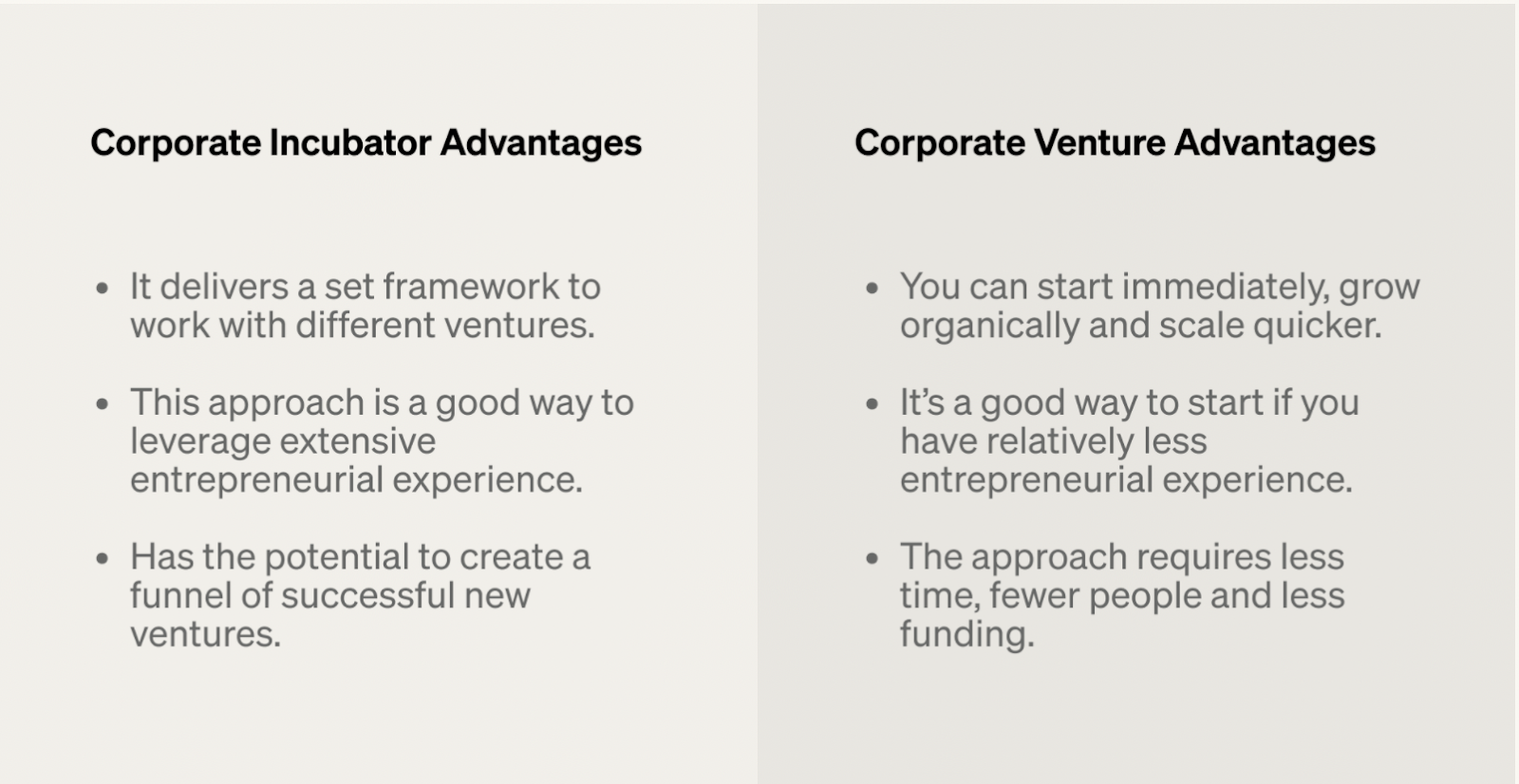

Corporate incubators vs corporate ventures

Many companies start their corporate venturing journey either by building a single venture or by setting up a venture building machine, aka, corporate incubator. To help you figure out which approach is right for you, we’ve defined each tool in more detail and outlined some of their advantages and disadvantages below.

Corporate incubation

Corporate incubators or in-house incubators operate within a corporate setting. They leverage internal assets, talent, networks and other resources to support intrapreneurs in building new ventures from scratch. The incubator approach essentially creates a framework or program to build a pipeline of new ventures.

Corporate venture building

Instead of building a program (like a corporate incubator), this approach focuses on building a single venture. Teams can immediately cut to the chase, learning as they go and hitting actual milestones a lot faster (e.g. MVP, launch, scale, etc.). It enables teams to start small and gain insights through their own “on-the-job” experiences.

The advantages

Despite their many similarities, these techniques tackle corporate venturing in different ways. Let’s take a look at the different benefits of each approach:

The disadvantages

Now, let’s take a look at some of the drawbacks of each approach:

If your company has a wide range of entrepreneurial experience - starting an incubator is probably the right way to go. Here are just a few of the questions you should consider:

- Does your company have any corporate venturing experience?

- Does anyone on your team have experience working with startups?

- Is there currently any type of venturing process in place (e.g. M&A)?

- Have you developed any internal innovation projects?

The more “YES” answers you have, the better the chance that you can start with a larger incubation program.

Choosing the right governance, funding, and legal setup

A crucial part of ensuring the success of your ventures is to identify and establish the right governance, funding, and legal setup—a triad that serves as the backbone of their operations:

Let’s take a look at each of these elements individually:

Choosing the right governance structure

Governance structures help you navigate the balance between autonomy and control. It is the framework that outlines the decision-making process and how your venture is run. Elements of a strong governance framework include:

- Clear roles and responsibilities for the venture board and management team

- Policies and procedures that guide decision-making

- Regular review and updating of your governance framework

While every venture is unique, in most cases, you’ll need a setup that includes:

- A venture board: corporate sponsors that provide strategic advice

- A venture team: developers, creatives and experts that execute ideas

Choosing the right funding setup

Funding is the lifeblood of any business, and choosing the right funding setup is critical to the success of your corporate venture. Let’s take a look at some of the potential options:

- Internal funding: Allocating corporate parent capital to finance the corporate venture.

- External funding: Raising capital from outside sources, e.g. VCs, banks, or partners.

- Hybrid funding: Combines elements of both, offering a more balanced approach.

Choosing the Right Legal Setup

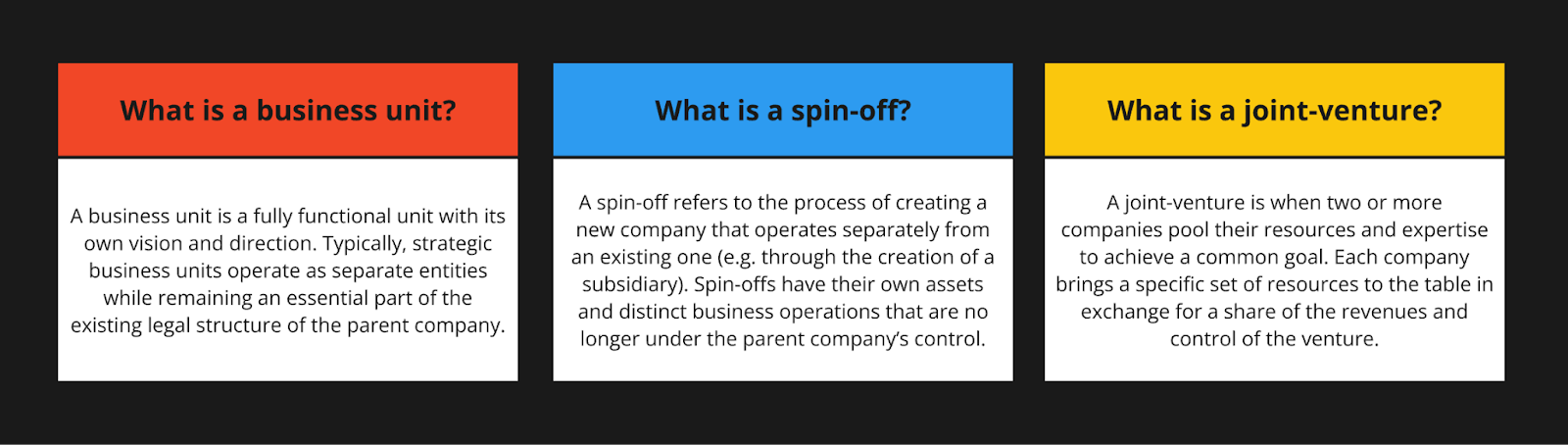

Finding the right legal entity setup for your corporate venture will have a crucial impact on its success and how fast it reaches profitability. With so many options to choose from (e.g. spin-off, spin-in, business unit, etc.), it can be a daunting process with no straightforward answer.

For the purposes of this article, we’ll focus on business units, spin-offs and joint ventures since they’re the most common options for companies that want to expand past their core activities to accelerate growth.

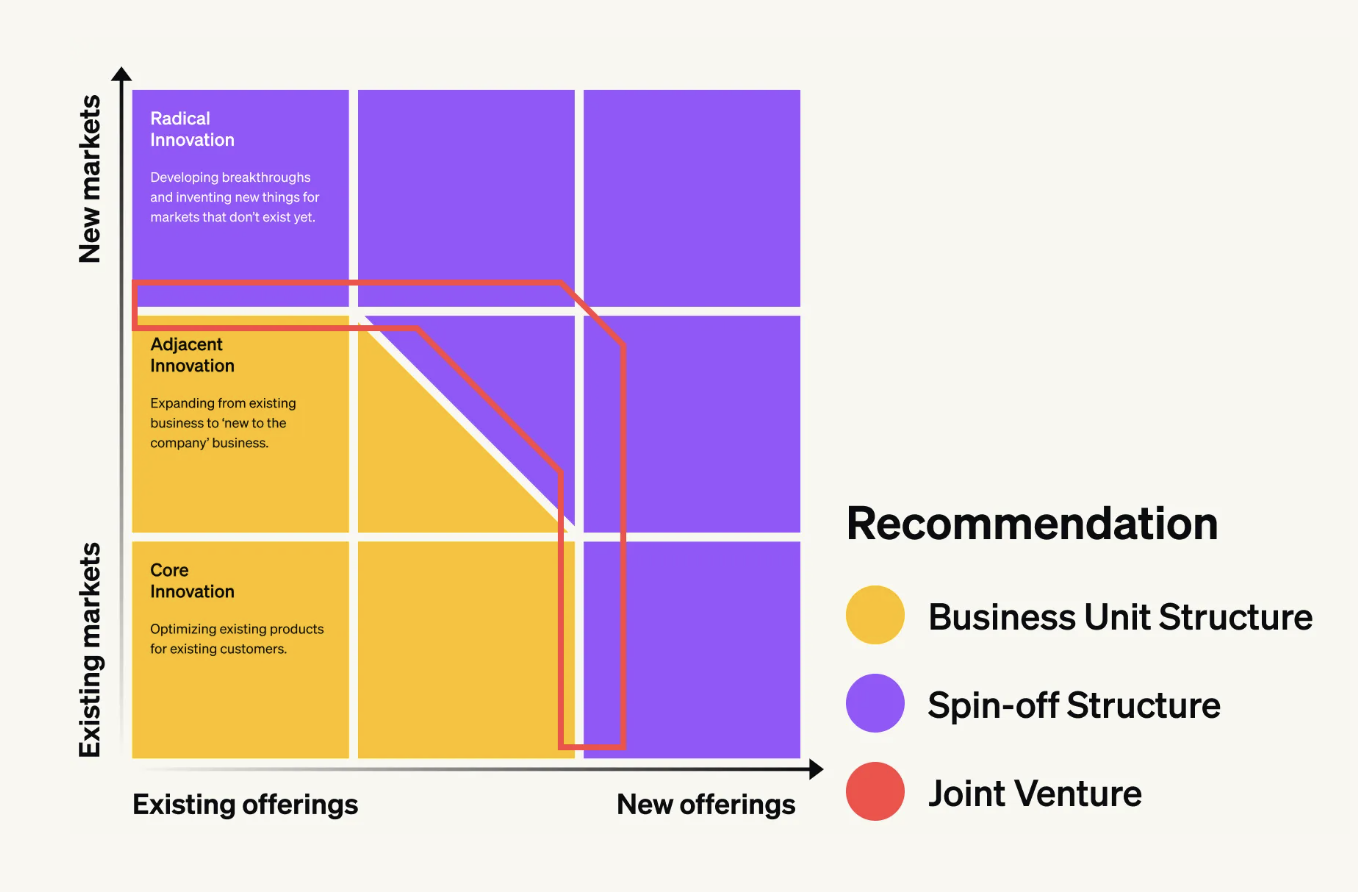

When determining the ideal legal entity for your corporate venture, consider its proximity to your core business. The more removed it is, the less likely it will be to rely on core assets, making a spin-off arrangement the better option. Use the innovation matrix below to help guide your decision.

How to choose the right metrics for your corporate venture

Each phase of your venture journey has its own unique set of challenges and goals, and your metrics should reflect that. For example, during the early stages, you might care more about problem-solution fit and market potential, while later stages call for metrics related to scalability and profitability.

Tailoring your metrics to your venture activities will help you make smarter decisions about resource allocation, manage risks more effectively, and communicate progress to stakeholders in a way that makes sense for each stage.

To help guide you through the process, here are some of the most common challenges that companies face, along with some pro tips to help you avoid them.

An over-reliance on quantitative metrics

While quantitative metrics are crucial for their objectivity and ease of tracking, they can overlook the nuanced outcomes of venturing activities. An excessive focus on hard numbers may ignore valuable qualitative results like strategic alignment or customer satisfaction.

How to avoid it:

Implement a balanced scorecard approach that includes both quantitative and qualitative metrics. For instance, complement financial return metrics with regular stakeholder surveys or case studies to capture intangible benefits.

Misalignment between chosen metrics and strategic goals

Metrics should directly reflect and support the overarching strategic objectives of both the venture and the parent company. Misalignment can lead to pursuing ventures that appear successful on paper but do not contribute meaningfully to the company’s long-term strategic goals.

How to avoid it:

Review and align metrics regularly with corporate strategy. Involve key stakeholders from various departments in the metric selection process to ensure comprehensive alignment.

Using metrics as targets

When metrics are treated as targets, there’s a risk of focusing on them too narrowly at the expense of broader objectives. This can undermine the metrics' original purpose and lead to suboptimal decisions.

How to avoid it:

Use a diverse set of metrics and avoid tying compensation or evaluations too closely to any single metric. Regularly review and update your metric set, encouraging teams to flag potential opportunities or risks that fall outside the current metric framework.

Balancing short-term and long-term

Corporate venturing often involves initiatives that will only show their full potential in the long run. Relying heavily on short-term metrics can make it difficult to justify the initial investments in these ventures, potentially cutting off promising opportunities prematurely.

How to avoid it:

Use milestone-based metrics for long-term projects and pair them with short-term operational efficiency metrics.

Quantifying intangibles

Many corporate ventures aim to achieve strategic benefits such as gaining market insights or developing new capabilities, which are crucial but challenging to measure quantitatively. Finding ways to quantify these intangibles can be a significant hurdle.

How to avoid it:

Develop proxy metrics or qualitative assessment frameworks for intangible benefits. For example, track the number of insights shared across the organisation or use capability maturity models.

Comparing apples to oranges

Different ventures often have vastly different goals, timelines, and contexts, making standardised comparisons challenging. This diversity makes it hard to apply a standardised set of metrics across all ventures without losing meaningful insights from specific contexts.

How to avoid it:

Use tailored, context-specific metrics for different types of ventures. Being aware of these challenges and the possible solutions will enable you to develop more effective metric frameworks for your venturing initiatives.

Be sure to check out our report on corporate venturing metrics for more tips and best practices.

Why do corporate ventures fail?

We've all heard the statistic that 90% of new businesses fail within their first year for various reasons:

- Lack of funding

- Incompatible teams

- Inadequate validation and proof

- Inadequate marketing

Even corporate ventures, which have a significantly higher chance of success due to the smart leveraging of corporate assets, aren’t immune to the possibility - and there are plenty of examples to prove it.

The good news is that each failure delivers an endless array of insights, strengthening your company’s capabilities, knowledge and expertise and helping you avoid detrimental mistakes in the future. In other words, failure can be used productively. The trick is to keep your losses controlled and small by constantly validating various elements using lean experimentation techniques. This approach allows you to fail forward and gain the insights needed to make key decisions: iterate, pivot, or kill it.

Corporate venturing as part of your innovation strategy

Corporate venturing is a cost-efficient and effective way to accelerate growth, create new revenue streams and innovate:

- Bringing a deeper understanding of customer pain points and preferences

- Enabling companies to optimise their business models and offerings

- Facilitating out-of-the-box applications for new technologies

- Acting as a springboard for the creation of future products and services

However, despite the vast rewards, it’s not a risk-free process and requires careful planning, preparation and an entrepreneurial mindset to execute successfully. Working with the right innovation tools, techniques and partners can go a long way in helping you overcome any risks and get the returns you’re looking for.

For more details, read what these four leading innovation experts had to say about innovation governance, agile organisations, targets, KPIs, and the very definition of corporate venturing.

_____

At Bundl, we help companies leverage their unique assets to boost innovation and accelerate growth from within. We’d love to be part of your corporate venturing journey and turn your vision into thriving new revenue streams.