Corporate spin-offs: An introduction

Corporate spin-offs seem to have gone mainstream during the last few years, with some of the world’s biggest companies making moves to divest, streamline their operations, and unlock new opportunities. In a climate marked by fewer IPOs, rising interest rates and below-average economic growth, spin-offs can be a win-win for both the parent company and the new entity:

- Reducing risk for the parent company

- Freeing the new spin-off from bureaucratic constraints

- Enabling them both to pursue more tailored strategic directions

As a result, we’re bound to see more companies spinning off their ventures as a strategy to:

- Attract new investors

- Sharpen its strategic focus

- Scale its operations

- Meet regulatory requirements

- Increase value for shareholders

In most cases, the parent company retains a stake in the new entity, creating a vested interest in the spin-off's growth and prosperity.

To give you a better idea of how spin-offs work in practice, how they create value and how to successfully launch them, we’ve created this detailed guide with everything you need to know.

What is a corporate spin-off?

A corporate spin-off is created when a parent company separates a venture to create a new, independent entity. The decision to spin-off a venture is usually prompted by the expectation that it will be more profitable as an autonomous entity than under the parent company.

The newly formed company operates autonomously, with its own leadership team, IP, resources, and strategic objectives. However, in most cases, it will retain strong ties to the parent company through shared investments, strategic partnerships, or equity stakes. It’s also quite common for the spin-off to continue to get support from the parent company (e.g. funding and resources).

One of the critical advantages of a corporate spin-off is the ability for both entities to pursue their own strategic goals without constraints:

- Less risk for the parent company

- No bureaucratic contains for the spin-off

This often leads to a sharper strategic focus, enabling the spin-off to adapt quickly to industry changes, innovate, and potentially capture market opportunities more effectively.

What are the benefits of spinning off a venture?

Here are just a few of the benefits of spinning-off a corporate venture:

Enhanced focus

Both the main company and the new entity can really zero in on what they're good at. This means they can run their operations more smoothly and effectively.

Increased shareholder value

Spinning-off a venture often leads to a bump in its market value. This is because investors can better understand the value of a standalone venture, which can lead to an increase in what shareholders earn.

Increased agility

Spin-offs are usually smaller and not bogged down by corporate bureaucracy, so they can move quickly, adapt to changes, and innovate without hassles or delays.

Investor appeal

Spin-offs with a clearly defined focus tend to have an easier time attracting investors interested in that particular segment.

Operational efficiency

Spin-offs can make decisions faster and tailor their operations, which usually means things run more efficiently.

Partnerships and growth opportunities

Spin-offs can explore partnerships and growth opportunities that weren't possible under the parent company, potentially opening new doors for success.

Can help with regulatory and tax requirements

Spin-offs can facilitate compliance with regulatory and tax requirements by separating conflicting or regulated business units, reducing risk and legal complexities.

What is the difference between a business unit and a spin-off?

Corporate entrepreneurs often face the dilemma of whether to turn a venture into an internal business unit (spin-in) or a spin-off. To help you make an informed decision, let’s compare the two options.

Definition

Business Unit

Operates as a separate unit, but it is also an essential part of the existing legal structure of the parent company.

Spin-off

A newly created company, with its own assets and distinct business operations that are no longer under the control of the parent company.

Strategy & Governance

Business Unit

Easier to maintain strategic synergies and an aligned reporting structure.

Spin-off

Easier to maintain focus, more autonomy, and a faster decision-making structure.

Legal & Procurement

Business Unit

Easier to leverage corporate power, procedures, and supplier network.

Spin-off

Easier to insulate from liability, set up faster with tailor-made procedures, and have more freedom to operate.

People & Operations

Business Unit

Easier access and leverage of internal resources and HR department.

Spin-off

Easier to have a dedicated leadership team, faster hiring procedures, and equity incentives are possible

Finance & Tax

Business Unit

Ability to tailor to the needs of the corporation

Spin-off

Ability to tailor to the needs of the spin-off and unlock shareholder value.

Branding & Marketing

Business Unit

Easier to leverage existing brand portfolio, channels and departments

Spin-off

More flexibility to experiment with new brands, channels & marketing tools

Other

Business Unit

Ability to leverage the existing assets of the corporation as an unfair advantage.

Spin-off

Ability to build a tailor-made environment and team

Why do corporations spin off ventures?

Companies choose to spin-off ventures for a variety of reasons, including:

Boosting innovation

To create a focused, independent environment that nurtures the development of new technologies or business models.

Attracting investment and talent

To draw interest from venture capitalists and top talent attracted to the agility and potential of startup-like environments.

Increasing shareholder value

Allowing the market to assess the spin-off's potential separately from the parent company, which can often lead to higher value.

Streamlining operations

To allow the parent company to concentrate on its core competencies by offloading non-core activities to the spin-off.

Risk management

To manage the risks associated with innovative or experimental projects away from the parent company's balance sheet and reputation.

Regulatory compliance

To achieve compliance with regulatory requirements.

Cultivating strategic partnerships

To enable more flexible and strategic collaborations for the new entity outside the corporate structure.

Another potential reason to create a spin-off is the need to divest from underperforming units. Turning them into an autonomous spin-off with its own team and investors increases the chances that the new entity will succeed.

Examples of successful corporate spin-offs

To give you a better idea of what successful corporate spin-offs are like, here are two real-world examples:

1. SQUAKE

Year of spin-off: 2021

Parent company: Lufthansa

SQUAKE is a climate-tech startup that makes it easier for travel and mobility companies to develop sustainable offerings. It leverages API technology to connect companies to its platform and enable them to calculate the CO2 emissions of their activities. As described by SQUAKE CEO and co-founder Philipp von Lamezan:

"For many companies in the travel, mobility and logistics industry, making the switch to sustainable offerings represents a major obstacle. This is precisely where SQUAKE comes in: We are helping companies create flexible offerings and products that meet their customers’ needs with a solution that is easy to implement…"

To offset their emissions, companies are provided with access to a variety of climate protection projects and CO2 reduction technologies.

Since spinning-off from the Lufthansa Innovation Hub back in 2021, SQUAKE has gained two new investors: neosfer (formerly Main Incubator) and BackBone Ventures. Together with Lufthansa Group (SQUAKE’s original investor), these companies are providing SQUAKE with the support and expertise it needs to scale its operations.

2. TreasurUp

Year of spin-off: 2021

Parent company: Rabobank

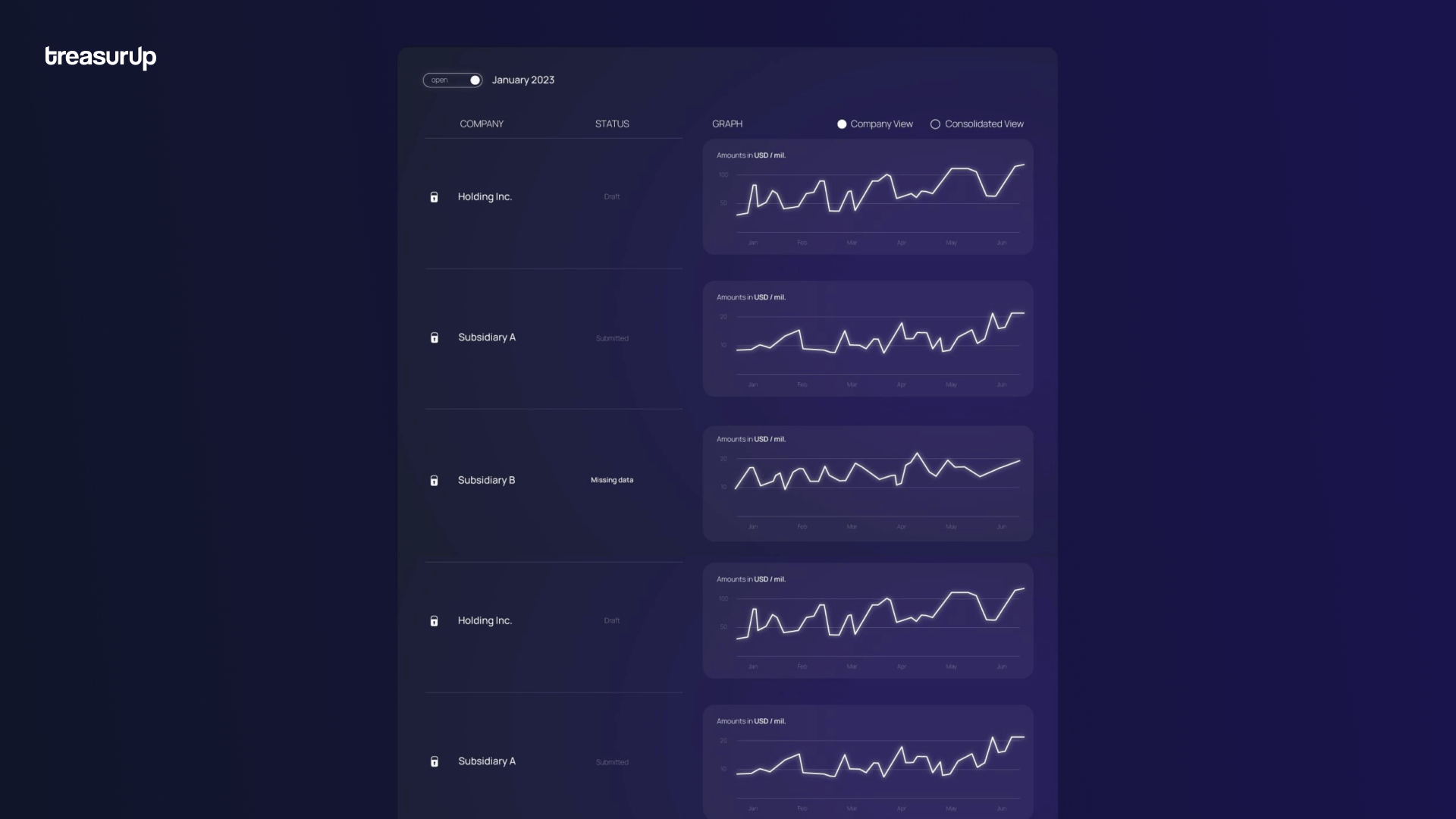

TreasurUp provides banks with white-label, cloud-based web and mobile front-end solutions created to meet the needs of corporate clients in areas like risk management, liquidity management and finance. Its services focus on helping banks grow in the commercial banking space by providing their business clients with a constantly improving online experience (designed by corporate treasurers) through web, mobile, and APIs. As explained by TreasurUp CEO Niels van Daatselaar:

"Banks around the world are challenged with new business models and technology for small and medium-sized corporate clients. TreasurUp aims to bring them back into the competitive arena with online services that are completely designed around SMEs.”

Through its innovative and user-friendly platform, TreasurUp helps businesses achieve greater financial control and visibility, supporting better decision-making and financial health.

Since being spun off, TreasurUp has focused on expanding its operation outside Europe as well as developing new treasury modules and services for banks.

How do you know when to spin-off or spin-in a venture?

When deciding whether to spin-off or spin-in a corporate venture, you should consider the strategic, financial, and operational implications. Here’s a breakdown of some of the key factors that can help guide your decision:

Decide on the best strategic fit

Evaluate how well the venture aligns with the parent company’s vision and goals.

- Spin-in if: The venture closely aligns with the core business’s strategic direction, enhancing its competitive edge or filling a strategic gap.

- Spin-off if: The venture is too far outside the core strategic focus, presenting opportunities outside the parent company's primary market or expertise.

Conduct a financial analysis

Conduct a financial analysis to understand the venture's current and potential value both within and outside the parent company.

- Spin-in if: The venture can bring significant returns or cost savings when integrated.

- Spin-off if: The venture can achieve a higher valuation or attract more investment as an independent entity.

Go where the opportunities are

Analyse the market dynamics, including competition, the regulatory environment, and growth opportunities, to determine where the venture would thrive best.

- Spin-in if: Your analysis shows that the venture will strengthen the parent company's market position or benefit from corporate resources, networks or brand strength.

- Spin-off if: The venture operates in a significantly different market than the parent company, requiring a distinct brand or business model to succeed.

Consider the operational pros and cons

Assess the operational implications, including resources, capabilities, and efficiencies, of both scenarios.

- Spin-in if: Integrating the venture can lead to significant operational synergies, shared resources, and capabilities that enhance efficiency and innovation for the corporate.

- Spin-off if: The venture’s operations require unique capabilities, culture, or speed that is better supported outside the parent company’s operational framework.

Evaluate the impact on stakeholders

Consider the impact on all stakeholders, including employees, customers, and shareholders.

- Spin-in if: Integration would benefit stakeholders through enhanced offerings, career opportunities, return on investment, etc.

- Spin-off if: It boosts value for shareholders, creates opportunities for employees, or enables more specialised investment and strategic partnerships.

10 key steps to making your corporate spin-off a success

While there is no “one size fits all” formula for success, the steps below can help ensure your spin-off thrives as an independent entity and creates value for stakeholders:

Step 1. Define your incubation and acceleration processes

Establish clear stages for incubating ventures internally and conditions for transitioning them to external partnerships or spin-offs.

Step 2. Assess the venture’s strategic alignment

Review venture ideas to determine how well they align with core capabilities and strategic objectives. Based on that, you can choose whether to spin-off or spin-in.

Step 3. Analyse the Market Potential and Competitive Position

Evaluate the market demand for the venture’s offerings and its competitive position within the industry. This step should help identify if the venture has a stronger market fit and growth potential independently or as part of the larger corporation.

Step 4. Conduct a thorough financial analysis and forecasting

Assess the venture's financial health, future revenue potential, and funding needs. This includes analysing whether the venture can deliver better value to shareholders as part of the parent company or as an independent entity.

Step 5. Foresee the operational implications

This can include setting up independent IT systems, operational processes, supply chains, and employee transitions. It's crucial to ensure that both the parent company and the spin-off can operate effectively post-separation.

Step 6. Define the financial structure

Determine the spin-off's financial structure, including the distribution of assets, liabilities, and equity. This involves accurately valuing the new entity and deciding on the capital structure that will support its growth and operational needs.

Step 7. Protect your IP

When a venture is spun off and needs to incorporate corporate IP, the process of transferring ownership can be complex and financially intricate. Licensing the IP instead of transferring ownership can be a more straightforward and tax-efficient method.

Step 8. Determine the Leadership Structure

Decide on a leadership composition for ventures, ensuring a balance between internal influence and external entrepreneurial leadership.

Step 9. Consider the Legal, Regulatory and Tax Implications

Understand the legal, regulatory, and tax consequences of either spinning-in or spinning-off. This includes considerations around how each option affects shareholder value, compliance costs, and any potential tax benefits or liabilities.

Step 10. Develop a Comprehensive Risk Management Plan

Identify key risks associated with both spinning in and spinning out, including operational risks, market risks, and integration or separation challenges. Your findings will enable you to develop strategies to mitigate these risks.

Final thoughts

When executed skillfully, corporate spin-offs can be a powerful strategy to unlock value and foster innovation with reduced risk. By focusing on their core strengths, both the parent company and the spin-off can pursue growth more effectively, each attracting targeted investments and talent that align with their specific goals and market positioning.

Be sure to get in touch for more information on how to execute your own corporate spin-off or if you have any questions about the process.

_________

Looking to launch your first or next spin-off? We can help you leverage insights gained during your validation initiatives to lead your venture to scale and beyond.