Key takeaways

For years now, fintech startups have been revolutionising conventional financial services, making them faster, cheaper, more accessible and way more convenient. Disruptive players like N26, Revolut and Monzo have been reshaping the industry, shifting it from product-based to customer-based models.

If we look at the recent numbers, the trend is showing no signs of a slow down:

- The digital banking sector will increase to $8,7 b in 2025 from $6,5 b in 2018.

- Users in the digital payments segment are expected to reach 4,6 b by 2024.

- In the UK, 23% of adults have opened an account with a digital-only bank.

Traditional banks have been quick to respond by investing in their own winning fintech ventures and backing fintech startups with high potential.

This week’s corporate startup, DNB’s Vipps, has quickly become the leading mobile payment method in Norway. Today, most Norwegian consumers don’t “pay”; they just “Vipps” it!

How it all started.

Digital banking and fintech payment apps, in particular, offer consumers a myriad of benefits:

- Easy access via the internet and mobile apps.

- Increased processing speed.

- Service cost reductions.

- A strong focus on customer service.

- High levels of financial transparency.

- Open banking and the use of open application programming interface (API)

The list is virtually endless and particularly appealing to millennials and Gen Zers, both of whom are gaining spending power every year.

Like most banks, DNB (one of the biggest banks in Norway) was exploring different ways to enter the space. In 2015, DNB launched its very own person-to-person (P2P) mobile payment solution to simplify payments for their customers.

Meet Vipps.

Although Vipps started as a simple payment app, within six months of its launch, it had already reached 1 million users. DNB’s tech partner, TCS, credits the app’s quick rise to its “first-mover advantage”.

As more features and improvements were made, Vipps gained more users, making it a real contender in its industry. By 2017, it was competing with several rival platforms like MobilePay and other international players like Facebook, Google and Apple.

To solidify its position as the leading payments app in Norway, DNB decided to spinout the startup, retaining a 52% controlling interest. The remaining 48% stake was jointly acquired by a group of over 100 banks including SpareBank 1 alliance, the Eika alliance and Sparebanken Møre.

In 2019, VIPPS partnered with five other European wallets (Blucode, Pivo, ePassi, Momo Pocket, Pagaqui) with an aspiration towards a European wallet alliance. VIPPS users were then able to pay with their wallet abroad using QR-codes, based on the Alipay QR-code format.

Today, most businesses in Norway take Vipps, some even dedicating special check-out lines for Vipps users only. Signs like, “Ja, her kan du betale med Vipps!” (Yes, you can pay with Vipps here!) are quite common and the service is available to both DNB and non-DNB customers.

How it works.

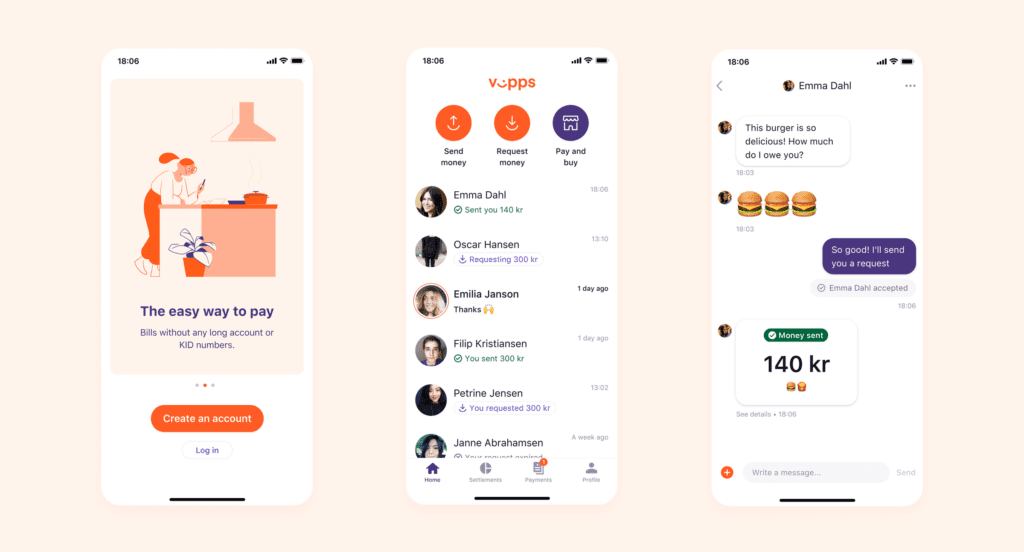

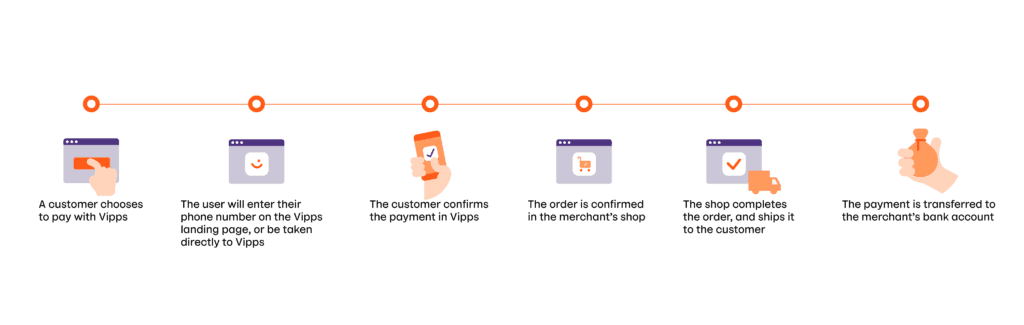

Setting up a Vipps account is relatively easy; you can download the app for IOS or Android and then enter your personal ID number, eight-digit phone number, bank account and debit card info. Once that’s done, you can use the Vipps app to:

- Send and receive peer-to-peer payments.

- Get paid for products and services through your own website.

- Pay for subscription services.

- Make over-the-counter payments.

- Pay bills.

- Use the BankID feature to sign online documents.

Making payments through Vipps is convenient because you don’t need the recipient’s bank information; you can simply send the payment using their phone number (which you’re likely to have already).

The benefits.

For DNB, investing in their own fintech startup has really paid off:

- Through Vipps, DNB is connecting with new customers and increasing their chances of gaining market share.

- The data gathered through the Vipps app can yield valuable insights about consumer purchasing patterns and preferences. This can be leveraged to improve existing services and create new offerings.

- Vipps’ annual revenue has been reported at $151,09 m, adding to DNB’s overall profits.

- Through the new venture, DNB got to test new technologies and a new business model. The learnings can be scaled to enhance other areas of their business.

As for Vipps, it probably wouldn’t have become the leading payments app in Norway without the funding, guidance, partnerships and expertise of its parent company.

What’s Next?

According to Statista, Vipps surpasses 100 thousand daily active users in 2020, holding strong as Norway’s leading mobile payments app.

Both DNB and Vipps have plans to expand the app and make it available to users across Europe. In September of this year, Vipps announced that it had struck a deal with Visa as a step to help them achieve that goal. As described in a statement by Vipps:

“The partnership between Visa and Vipps will give banks, and card issuers access to a mobile wallet that is easy to use and which will contribute to an increased adoption of digital payments.”

With its current popularity at home and plans underway for a European expansion, the sky is the limit for this young Fintech startup. Keep reading our corporate startup stories for future updates!

Are you interested in exploring new growth areas and creating new concepts to diversity your portfolio? Get in touch!

50 Corporate Venture Examples

Find out how top companies build ventures from scratch to unlock markets, fuel growth, and generate new revenue.