Corporate venturing metrics: An introduction

Accurately measuring the performance and impact of corporate venturing activities can be a complex endeavour. It requires a balanced approach that captures both tangible results like revenue and strategic results like insights—the latter of which can be challenging to quantify.

Finding and leveraging the right metrics is a key part of the process, enabling you to:

- Justify investments and allocate resources effectively

- Ensure your efforts remain aligned with corporate goals and objectives

- Make informed decisions about which ventures to pivot, scale, or exit

- Keep stakeholders, board members, and investors informed on the venture’s progress

- Identify areas for improvement and refinement in your venturing strategy over time

Each venture requires a tailored approach that reflects its unique set of targets as well as the parent company’s broader corporate growth goals.

In this guide, we’ll walk you through the different types of metrics you can use, the challenges, the best practices and a balanced framework designed to help you accurately measure tangible and intangible gains.

Let’s kick things off with some context.

The role of metrics in corporate venturing: Why they matter

Corporate venturing metrics are quantitative and qualitative measures used to evaluate the performance, progress and impact of a company's venturing activities. They can be used to track:

- Financial returns, e.g. revenue and profit margins

- Strategic returns, e.g. access to new markets

These metrics provide a clear and objective picture of how well a venture is performing and contributing to the broader goals of the parent company. Here are just a few of the ways they can guide the corporate venturing process:

- Performance evaluation: They help answer critical questions like: Are we achieving our goals? Is our investment paying off?

- Resource allocation: By providing concrete performance data, metrics enable more informed decisions about where to allocate resources for maximum impact.

- Strategic alignment: The right metrics can keep venturing activities aligned with the overall corporate strategy and avoid irrelevant opportunities.

- Decision making: Metrics enable data-driven decisions about which ventures to continue supporting, which to scale up, and which to exit.

- Stakeholder communication: Metrics provide a common language for discussing venture progress and challenges with management and stakeholders.

- Continuous improvement: Tracking metrics over time helps identify trends, pinpoint improvement areas, and refine venturing strategies.

Adopting a comprehensive set of metrics can help companies overcome many of the uncertainties associated with corporate venturing and ensure that their investments yield both financial and strategic benefits.

What types of corporate venturing metrics are there?

Corporate venturing metrics typically fall into one of the following categories:

Financial metrics

Financial metrics measure the monetary performance and returns of corporate venturing activities.

Examples:

- Internal rate of return (IRR): The annual growth rate expected from an investment.

- Multiple on invested capital (MOIC): The ratio of returns vs the amount invested.

Strategic metrics

Strategic metrics assess how well the venture aligns with and contributes to the parent company's overall strategic goals.

Examples:

- New markets entered: New geographic or product markets accessed through ventures.

- Strategic partnerships: Number of collaborations established through venturing activities.

Innovation metrics

Innovation metrics measure the venture's contribution to the company's innovation efforts and capabilities.

Examples:

- Number of new products or services launched: Offerings introduced to the market.

- Patents filed or acquired: Number of new intellectual property rights obtained.

Operational metrics

Operational metrics evaluate the efficiency and effectiveness of the corporate venturing process itself.

Examples:

- Deal flow: Number of investment or partnership opportunities evaluated.

- Investment pace: Average time from opportunity identification to investment.

Learning and development metrics

Learning and development metrics capture the knowledge, skills, and cultural changes that result from venturing activities.

Examples:

- Knowledge transfer rate: How effectively venture insights are shared in the organisation.

- Development of entrepreneurial skills: Growth in relevant capabilities among employees.

Risk assessment metrics

Risk assessment metrics help quantify and manage the various risks associated with corporate venturing activities.

Examples:

- Burn rate of venture investments: Speed at which venture capital is spent.

- Regulatory compliance index: Measure of adherence to relevant laws and regulations.

Each of these metric categories plays a crucial role in providing a comprehensive view of corporate venturing performance. The key is to select a balanced set of metrics that align with your specific venture goals, corporate strategy and the type of venturing activity you’re tackling (more on that below).

How do you tailor your metrics to your venture stage?

Each phase of your venture journey has its own unique set of challenges and goals, and your metrics should reflect that. For example, during the early stages, you might care more about problem-solution fit and market potential, while later stages call for metrics related to scalability and profitability.

.webp)

Tailoring your metrics to your venture activities will help you make smarter decisions about resource allocation, manage risks more effectively, and communicate progress to stakeholders in a way that makes sense for each stage. Here are a few examples of how your metrics can evolve along with your venture stage:

The conceptualisation stage

In the early ideation phase, focus on metrics that assess market potential and problem-solution fit. Key indicators during this stage might include:

- Growth rate: The projected growth rate of the market to ensure expanding demand.

- Problem-solution fit score: How well a solution addresses the identified problem.

- Break-even point: The point when total revenue equals total costs, indicating profitability.

The validation stage:

As concepts move towards validation, prioritise metrics that evaluate market traction and customer interest:

- Feasibility index: Measures technical, financial, and market feasibility.

- Customer lifetime value (LTV): The total revenue from a single customer account throughout the business relationship.

- Willingness to pay (WTP): The maximum amount a customer is willing to pay for a product or service.

The incubation stage

During incubation, track metrics that indicate growing customer engagement and product-market fit:

- Customer satisfaction score (CSAT): How satisfied customers are with an offering.

- Net promoter score (NPS): The likelihood of customers recommending an offering.

- Daily, weekly or monthly active users (DAU / WAU or MAA): The number of unique users engaging with a product or service over a given time period.

The acceleration stage

In the acceleration phase, the focus shifts to metrics demonstrating scalability and market penetration:

- Market penetration rate: The total addressable market that a company has captured.

- LTV/CAC Ratio: The ratio between the lifetime value of a customer and the cost to acquire that customer.

The growth stage

For maturing ventures, emphasise metrics that showcase market position and financial performance:

- Market share: The % of total sales in an industry generated by a particular venture.

- Return on investment (ROI): Used to evaluate the efficiency of an investment.

- EBITDA margin: Earnings before interest, taxes, depreciation, and amortisation as a percentage of total revenue, indicating operational profitability.

Think of it as a growth-oriented approach that adapts to and with your venture, and it moves through each stage of development.

Common metric selection challenges and how to avoid them

Selecting the right metrics to evaluate corporate venturing efforts can be fraught with difficulties. Here are some of the most common challenges that companies face, along with some pro tips to help you avoid them.

An over-reliance on quantitative metrics

While quantitative metrics are crucial for their objectivity and ease of tracking, they can overlook the nuanced outcomes of venturing activities. An excessive focus on hard numbers may ignore valuable qualitative results like strategic alignment or customer satisfaction.

How to avoid it:

Implement a balanced scorecard approach that includes both quantitative and qualitative metrics. For instance, complement financial return metrics with regular stakeholder surveys or case studies to capture intangible benefits.

Misalignment between chosen metrics and strategic goals

Metrics should directly reflect and support the overarching strategic objectives of both the venture and the parent company. Misalignment can lead to pursuing ventures that appear successful on paper but do not contribute meaningfully to the company’s long-term strategic goals.

How to avoid it:

Review and align metrics regularly with corporate strategy. Involve key stakeholders from various departments in the metric selection process to ensure comprehensive alignment.

Using metrics as targets

When metrics are treated as targets, there’s a risk of focusing on them too narrowly at the expense of broader objectives. This can undermine the metrics' original purpose and lead to suboptimal decisions.

How to avoid it:

Use a diverse set of metrics and avoid tying compensation or evaluations too closely to any single metric. Regularly review and update your metric set, encouraging teams to flag potential opportunities or risks that fall outside the current metric framework.

Balancing Short-term and Long-term

Corporate venturing often involves initiatives that will only show their full potential in the long run. Relying heavily on short-term metrics can make it difficult to justify the initial investments in these ventures, potentially cutting off promising opportunities prematurely.

How to avoid it:

Use milestone-based metrics for long-term projects and pair them with short-term operational efficiency metrics.

Quantifying intangibles

Many corporate ventures aim to achieve strategic benefits such as gaining market insights or developing new capabilities, which are crucial but challenging to measure quantitatively. Finding ways to quantify these intangibles can be a significant hurdle.

How to avoid it:

Develop proxy metrics or qualitative assessment frameworks for intangible benefits. For example, track the number of insights shared across the organisation or use capability maturity models.

Comparing Apples to Oranges

Different ventures often have vastly different goals, timelines, and contexts, making standardised comparisons challenging. This diversity makes it hard to apply a standardised set of metrics across all ventures without losing meaningful insights from specific contexts.

How to avoid it:

Use tailored, context-specific metrics for different types of ventures.

Being aware of these challenges and the possible solutions will enable you to develop more effective metric frameworks for your venturing initiatives.

Best practices for selecting corporate venture metrics

Now that we’ve covered some of the key challenges let’s explore some actionable best practices to help you more effectively measure your corporate venturing efforts.

Use different metrics for different innovation activities

Set specific metrics that reflect the unique risks, goals, and timelines of various innovation activities like accelerators, incubators, or venture building.

Pro tips:

- Use traditional metrics like ROI for lower-risk, incremental innovations

- Focus on strategic value metrics for high-risk ventures to gauge their true impact

- Develop a matrix of metric types suitable for different innovation categories

- Regularly review and adjust metrics as ventures evolve

Align metrics with strategic goals

Make sure the success factors and corresponding metrics you select are aligned with your strategic corporate goals. This is crucial to securing sustained internal support for your activities, which is a key driver of corporate venture success.

Pro tips:

- Involve stakeholders in the KPI-defining process

- Focus on immediate financial results alongside long-term strategic metrics

- Conduct regular reviews and revisions of KPIs with key stakeholders

- Create a clear narrative linking venture metrics to overall corporate strategy

Leverage existing frameworks for sustainability projects

For ventures focused on sustainability, combine environmental impact assessments with traditional business metrics.

Pro tips:

- Adopt frameworks from impact investing to quantify things like waste reduction.

- Benchmark against existing industry standards for sustainability reporting.

- Collaborate with sustainability experts to ensure metrics are meaningful and measurable.

Continuously adapt your metrics

Regularly review and update KPIs to reflect evolving corporate strategies, venture stages and changing market conditions.

Pro tips:

- Schedule quarterly or bi-annual metric review sessions

- Involve cross-functional teams in the review process

- Analyse market trends and adjust metrics accordingly

- Maintain a log of metric changes and the rationale behind them

Incorporate flexibility and customer feedback

Design innovation frameworks to allow for flexibility and ongoing refinement, focusing on metrics that track customer loyalty and engagement.

Pro tips:

- Implement customer satisfaction and loyalty metrics (e.g., Net Promoter Score)

- Establish feedback loops to gather and analyse customer input regularly

- Create mechanisms for quick adjustments to products or services based on feedback

- Balance customer-centric metrics with internal performance metrics

Align metrics with incentives and rewards

Ensure that the metrics used to evaluate venture performance align with the incentives and rewards offered to the venture team.

Pro tips:

- Match incentive structures with desired behaviours and outcomes

- Regularly review and adjust the alignment between metrics and incentives

- Clearly communicate how metrics tie to rewards to ensure transparency and motivation

3 key factors to consider when choosing your metrics

While there is no one-size-fits-all approach to selecting the right metrics, considering these three key factors will help guide your decision-making process:

1. The stage of your venture

The growth stage of your venture plays a significant role in determining which metrics are most relevant. For example:

- Early-stage ventures (ideation or validation phases) might benefit more from learning and development metrics that measure progress in knowledge acquisition or proof of concept success.

- Mature ventures (scaling or growth phases) might lean more toward financial or operational metrics to track revenue growth, market penetration, or operational efficiencies.

2. The goals and purpose of your venture

The underlying objectives of your venture should guide your metric selection. For example, an environmentally focused venture will require different metrics than a financially focused one:

- Environmental ventures should integrate innovation metrics that capture their impact, e.g. carbon footprint reduction or increased recycling rates.

- Financially driven ventures usually require financially focused metrics like ROI, IRR, or profitability to ensure and showcase the initiative's success.

3. The context and environment of your venture

The context and environment in which your venture operates plays a role in metric seletion. This involves considering various factors like industry dynamics, competition, regulations, and overall market conditions.

Industry-specific metrics

These metrics are tailored to the unique characteristics and demands of your specific industry. They help assess how well your venture performs against industry-specific benchmarks and standards.

Competitive landscape

Understanding the competitive landscape allows you to select metrics that gauge your venture’s performance relative to competitors. This includes tracking market share, competitor growth rates, and innovation in your sector.

Regulatory environment

Metrics related to the regulatory environment ensure compliance with laws and guidelines crucial to your industry. These metrics help monitor adherence to regulations, the impact of legislative changes, and risk management.

Market conditions

These metrics reflect the broader economic and market trends affecting your venture. They can include consumer demand, economic indicators, and market volatility, which help in making informed strategic decisions and adjusting business models.

By considering the context and environment, you ensure that your metrics are not only relevant to your venture's internal goals but also reflect the external factors that can impact its success.

The NICE framework for venture metrics

The NICE framework was created in collaboration with Bundl Venture Club members to help corporate entrepreneurs select metrics that accurately and effectively measure corporate venturing efforts. The framework was designed to enable you to make data-driven decisions with data that goes beyond the often simplistic financial markers of success.

Let's take a closer look at how it works.

Non-financial metrics

Stakeholders gravitate towards financial metrics because they're clear, readily available, and easy to convey. However, focusing too heavily on these metrics can divert attention from the broader value that innovation activities bring.

The pitfalls of using only financial metrics include:

- Missed innovation returns due to their intangible nature.

- Many financial metrics are based on assumptions, which may not reflect reality.

- Focusing too heavily on ROI can interrupt and potentially hinder the innovation process.

Examples of non-financial metrics include:

Implementable metrics

Innovators should focus on metrics that genuinely aid in decision-making. This means prioritising implementable metrics over vanity metrics, which may look impressive but offer little real value in guiding business choices.

The pitfalls of vanity metrics include:

- They tend to be overly simplistic and misleading.

- They're often volatile and uncontrollable, making them difficult to replicate.

- They don’t show the full picture and don’t reflect the entire truth.

Implementable metrics that help decision-making include:

Contextual metrics

When selecting metrics, it's crucial to choose ones that can predict a venture's success well before it launches. However, the venture's phase (startup vs. scaleup), the business model (B2B vs. B2C), and the target audience are all critical factors that must be taken into account.

Why context matters:

- Different organisational levels require different metrics and reporting.

- Exploring unknown territory (i.e. radical innovation) requires relevant metrics.

- Early-stage ventures require a set of qualitative metrics instead of quantitative ones used in late-stage ventures.

Metrics that consider context include:

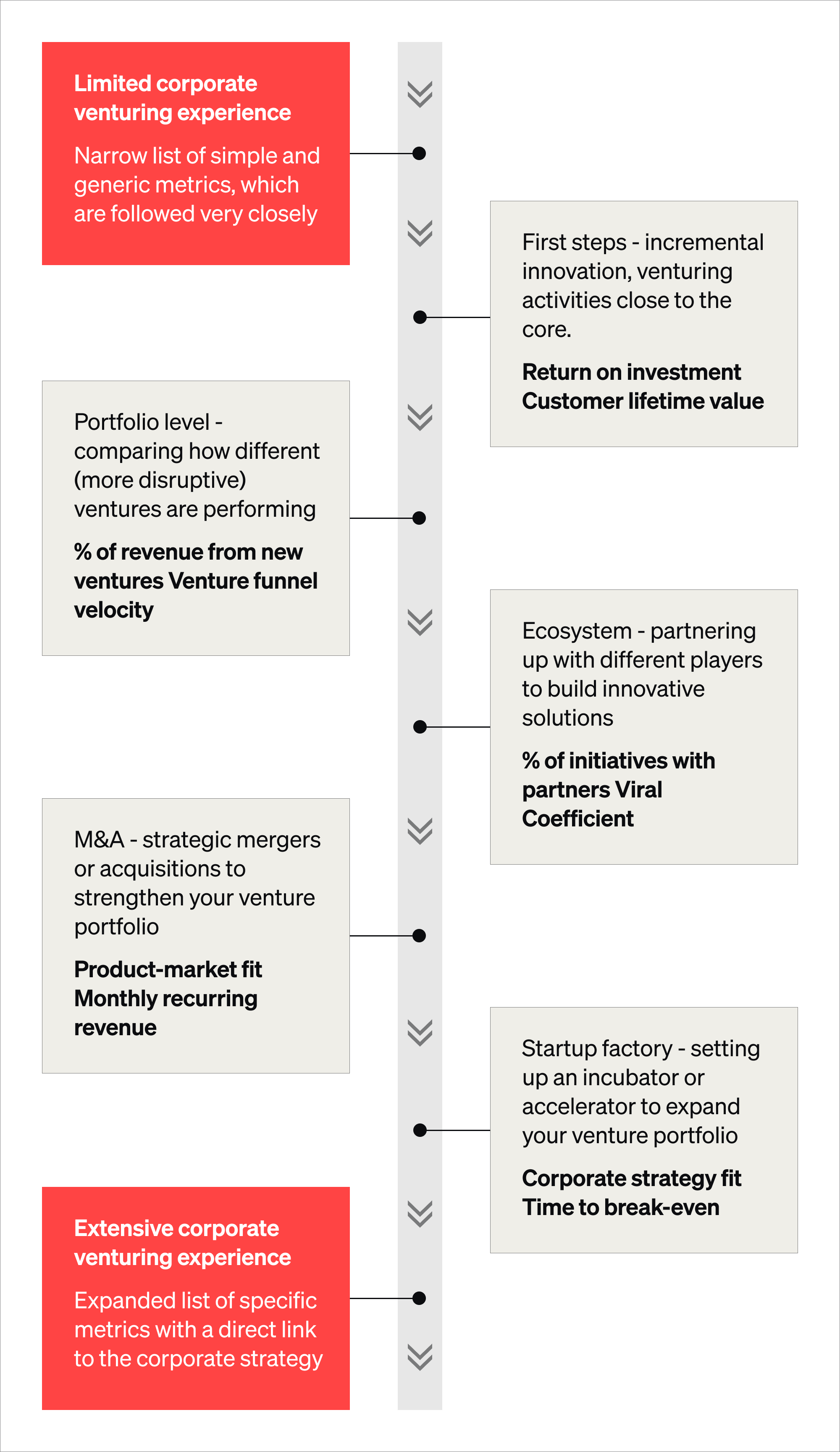

Evolving metrics

The process of measuring innovation should not be static; it needs to adapt as an organisation’s innovative capabilities develop. A set of metrics should be built step-by-step as the organisation's innovation expertise grows.

The pitfalls of static metrics include:

- Evolving channels and markets call for new metrics (e.g. digitalisation triggered new funnel metrics like CTR, CPC, retention rate, etc.).

- Implementing too many metrics at once is bound to get messy. Start with a few key metrics and gradually adjust by adding new ones or removing less relevant ones.

- Sticking to a fixed set of metrics doesn’t foster progress.

Metrics that can reflect your corporate venturing experience include:

The NICE framework was designed to accommodate industry changes, allowing it to be completely customisable as your strategy, customers, and ventures evolve. Download the full report for more information on how it works and to access the interactive canvas that goes with it.

Final thoughts

Remember, the goal of corporate venturing metrics is not just to measure performance but to drive better decision-making, foster innovation, and ultimately contribute to the long-term success of your organisation. Be sure to use the insights above to guide your efforts moving forward.

By thoughtfully selecting and implementing the right metrics, you’ll be able to effectively measure your venture's success, make data-led decisions on how to move forward, and effectively showcase its value to stakeholders.

For more information on how to create a tailored and accurate metrics framework to measure your corporate venture efforts, contact us. We’d love to hear from you!

_____

Want to test a new or existing venture with real customer data? We can help you leverage cutting-edge validation techniques to identify the ideal product-market fit, pricing, and features that your customers will love.